Table of Contents

On 09/09/2025, the Government issued Resolution No. 05/2025/NQ-CP on commencement of the piloting of crypto-asset market in Vietnam (“Resolution 05”). This is considered a major breakthrough, marking the beginning of the establishment and development of the domestic crypto-asset market. The Resolution shall be effect as of 09/09/2025 with the duration for the piloting set at 5 years. Below are some notable points regarding the crypto-asset market that CNC would like to share with readers.

Definition Of Crypto Assets

Crypto assets are a form of digital assets that utilize blockchain technology or technology of similar functions to authenticate asset throughout its formation, distribution, and transmission. Crypto assets do not include securities, or digitalized forms of fiat money and other financial assets provided for by civil and financial laws

Example of crypto assests: Bitcoin, Ethereum, NFT,…

In other words, insofar as the piloting is concerned, crypto assets is a form of legal digital assets expressed under digitalized forms, and formed, distributed, stored, transmitted, and authenticated by the above-mentioned blockchain in the digital environment and recognized by the laws of Vietnam.

Conditions For Offering And Distribution Of Crypto Assets

- Distributing Organization:

The organizations allowed to distribute crypto assets are Vietnamese enterprises, registrated and operated under the form of either limited liability companies or joint stock companies.

- Underlying assets:

Crypto assets must be distributed based on actual assets, other than securities and fiat money.

- Target:

Crypto assets could only be sold and distributed to foreign investors. Transaction between foreign investors must be made through crypto-asset service providers licensed by the Ministry of Finance.

- Methods:

The sales and distribution of crypto assets must be done on a platform for crypto assets hosted by a crypto-asset service providers licensed by the Ministry of Finance.

- Applicable Currency:

Offering, distribution, transfer, and payment of crypto asset must be done in Vietnamese dong.

- Announcement:

At least 15 days prior to the offering and distribution, the distributing organization must announce information on the Prospectus under Template No.1 of the Appendix enclosed with Resolution 05 and other related documents (if any) on the website of the crypto-asset service providers and the website of the distributing organization.

Detailed stipulation of requirement on offering and distribution of crypto assets allow for the foundation of a clear and consistent legal framework, ensuring the distribution are performed in accordance with the laws, mitigating risks while also laying the foundation for the safe, sustainable, and international norm-compliant development of crypto-asset market.

Transaction Between Investors

Domestic investors who own crypto assets and foreign investors are allowed to register multiple accounts at crypto-asset service providers under the princicple of only one account could be opened at each crypto-asset service provider.

Foreign investors shall open 01 bank account denominated in Vietnamese dong (regular account) at a Vietnamese credit institution to perform transactions related to the sale and purchase of crypto assets.

Payment order related to the sale and purchase of crypto assets in Vietname by foreign investors must specify the purpose of the transfer, which serve as the basis for bank to reconcile, review, archive documents, and ensure that foreign exchange services are performed consistent with their purposes and the laws.

Penalty Against Transactions Performed Through Means Other Than Crypto-Asset Service Provider

Six months subsequent to the licensing of the first crypto-asset service provider, domestic investors who perform crypto-asset transactions through means other than the crypto-asset service provider licensed by the Ministry of Finance, depending on the nature and the scale of the violation, shall be subject to administrative sanctions or criminal prosecution in accordance with the laws.

Crypto-Asset Service Providers

Scope of operation

Crypto-asset service providers are enterprise who provide one or some of the following services:

Resolution 05 details the scope of operation of crypto-asset service providers. Such detailed stipulation of the scope of operation of crypto-asset service providers enable enterprises to accurately identify their functions and liabilities, while also serve as the basis for regulatory authority to supervise and ensure the market is operated in a transparent, safe, and law-abiding manners.

Organization of crypto-asset trading market by crypto-asset service providers

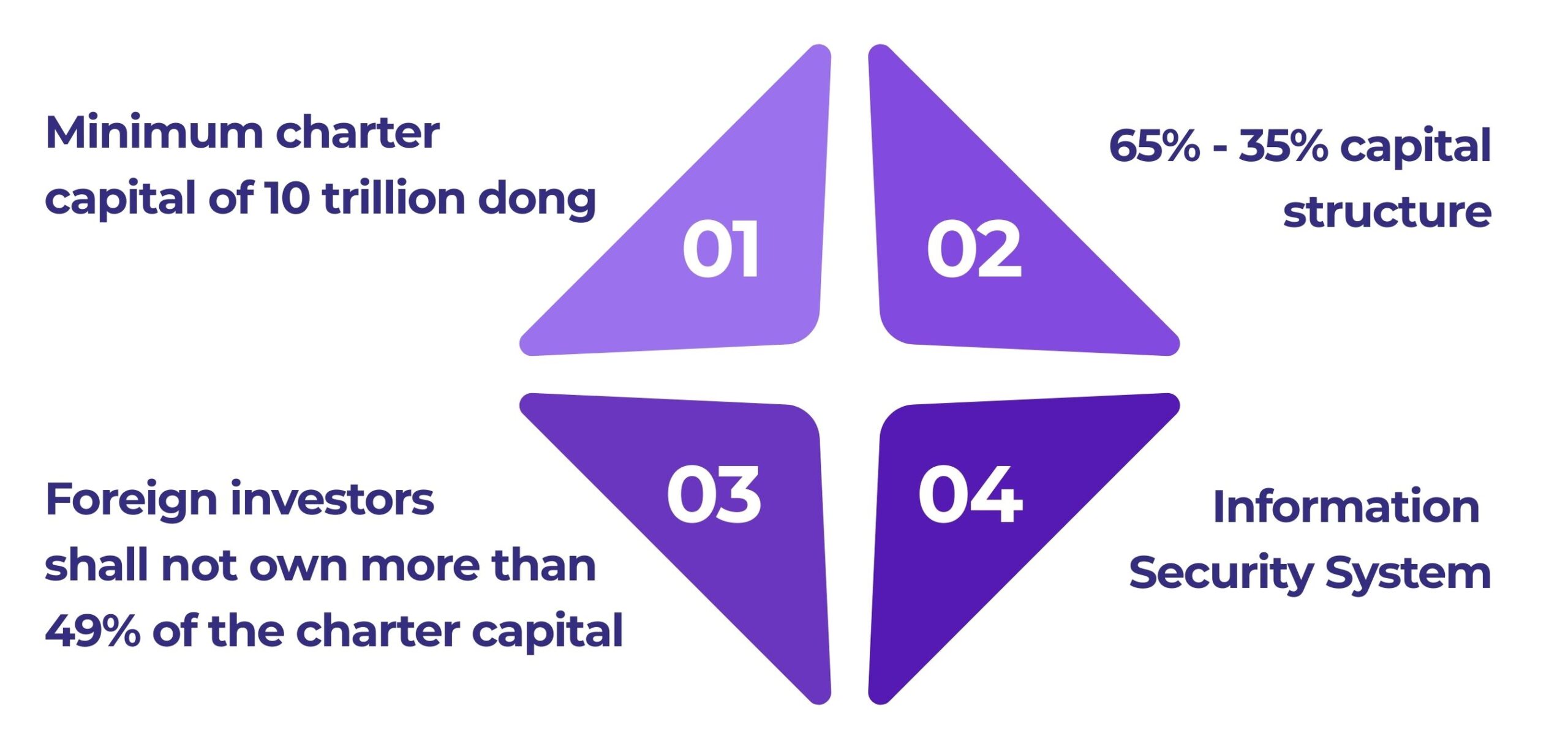

Crypto-asset service providers who organize crypto-asset trading market must comply with the legal requirements on capital as follows:

Minimum charter capital of 10 trillion dong

Capital contribution to the charter capital of crypto-asset service providers who organize crypto-asset trading market must be made in Vietnamese dong and amount to the minimum of 10 trillion Vietnamese dong.

The minimum charter capital requirement of 10 trillion dong aims to ensure crypto-asset service providers are financially capable of maintaining liquidity, addressing risks and preserving the interests of investors. The strict requirement would also filter out unqualified entity, mitigate possibility of cheating, while also align with international practices, which contribute to the foundation of a transparent and stable trading market.

65% - 35% capital structure

According to Resolution 05, shareholders and members who make investment or capital contribution into Crypto-asset service providers who organize crypto-asset trading market must comply with strict requirement on charter capital. To be specific:

- A minimum of 65% of charter capital must be owned by the organization (which are the shareholders and members). In which, at least 35% of the charter capital shall be owned by 2 organizations (that are commercial banks, securities companies, fund management companies, insurance companies, enterprises operate in the technology sectors).

- Organizations and individuals are only allowed to make capital contributions into 01 crypto-asset service providers licensed by the Ministry of Finance.

The requirement of the majority of charter capital must be owned by commercial banks and financial institutions would not only allow for a stable financial foundation, but also professional supervision and management. This also limit the possibility of platform operated by sponsetanous group of individuals, thereby mitigating risks and enhancing trust with investors.

Foreign investors shall not own more than 49% of the charter capital

According to the Resolution, the total value of capital contribution and share purchases made by foreign investors in a crypto-asset service provider who organize crypto-asset trading market shall not exceed 49% of the charter capital.

Information security system

Crypto-asset service provider must establish and maintain an information security system that meet the safety standard level 4 specified by the laws.

This is to ensure that the trading platform has high level of confidentiality, preventing risks of data disclosure and cyber attacks.

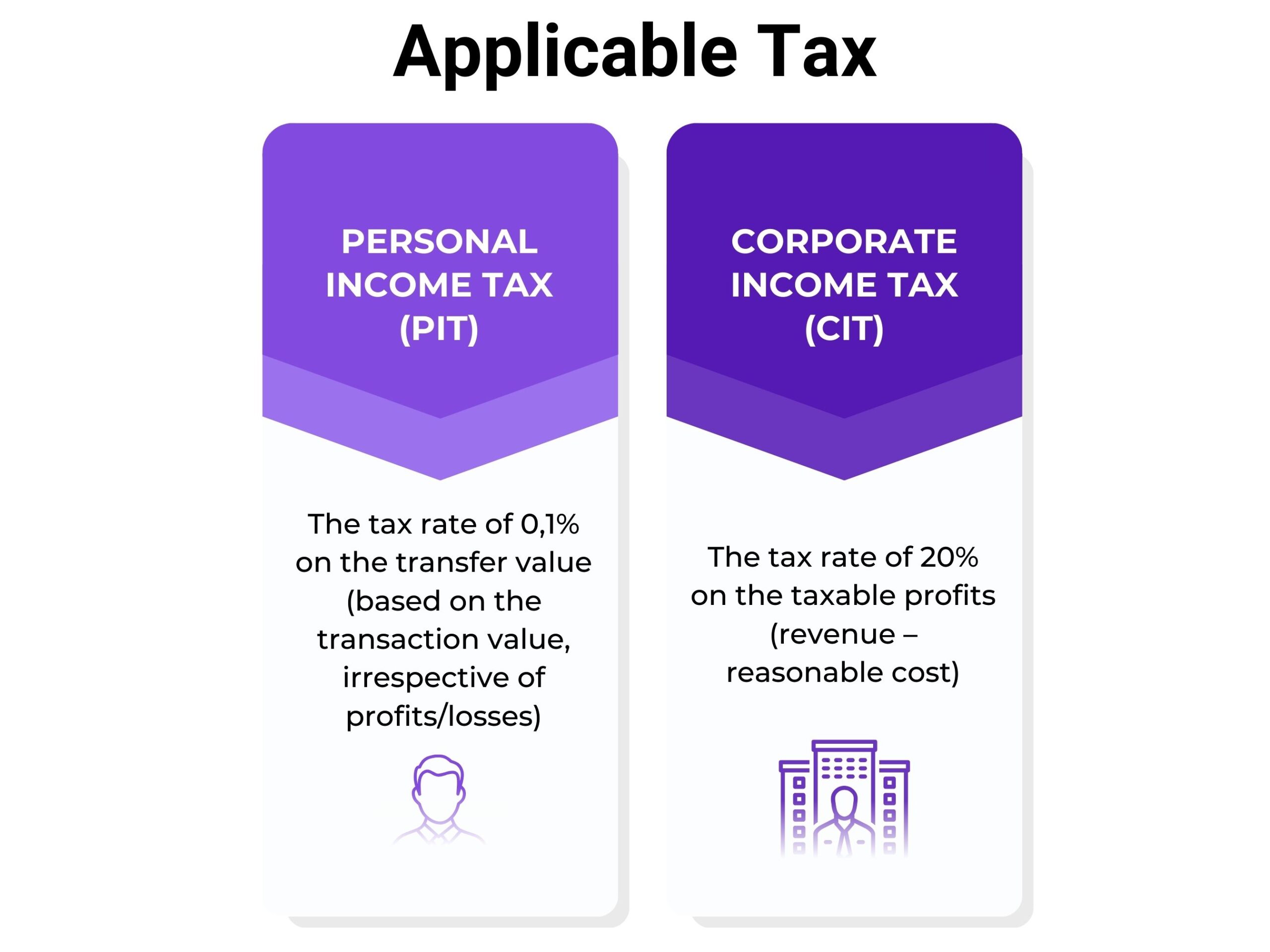

Applicable Tax

During the pilot duration, all transactions, transfer, and business related to crypto assets shall be subject to the tax policy similar to that of securities as provided by the applicable law. To be specific:

Personal Income Tax (PIT): Tax rate of 0,1% on the transfer value (based on the transaction value, irrespective of profits/losses). This is the “direct tax on transaction” mechanism, similar Đây là cơ chế “thuế trực thu trên giao dịch”, tương tự như khi cá nhân bán cổ phiếu.

Corporate Income Tax (CIT): Tax rate of 20% on the taxable profits (revenue – reasonable cost).

This is to ensure the consistency in the tax policy, establish a clear legal basis for transaction related crypto assets during the pilot duration, while also stabilize state budget revenue the and aid the development of the market.

Conclusion

Resolution 05/2025/NQ-CP on the piloting of crypto-asset market in Vietnam marks a milestone in the completion of the legal framework, paving the way for the development of the digital finance sector in a safe, transparent, and controlled manner. The pilot implementation not only establish a clear legal framework for involved organizations and individuals, but also attract foreign capital, technology, and experience, whilst taking into account national interest, financial security, and sustainable development of the market.

Disclaimers:

This article has been prepared and published for the purpose of introducing or informing our Clients and potential clients on information pertaining to legal issues, opinions and/or developments in Vietnam. Information presented in this article does not constitute legal advice of any form and may be adjusted without advance notice.

Leave A Comment