Tax Obligations for Real Estate Owners in Vietnam

Vietnam has emerged as one of the most dynamic real estate markets in Southeast Asia. Foreign investors are increasingly drawn to the country due to its impressive economic growth, young population, rising middle class, and improving infrastructure. From beachside villas in Da Nang to luxury apartments in Ho Chi Minh City, the investment opportunities are vast.

However, owning real estate in Vietnam is not just about picking the right location or developer—it also involves understanding and complying with Vietnam’s complex tax system. Whether you are a Vietnamese citizen, an expatriate residing in Vietnam, or a non-resident foreign investor, understanding your tax obligations is essential. This comprehensive guide explains the tax framework, common tax types, filing procedures, and practical advice to help you navigate property-related taxation in Vietnam successfully.

Legal Framework for Foreign Property Ownership

Vietnam’s Housing Law No. 27/2023/QH15, effective from August 1, 2024, outlines the rights and limitations applicable to foreign individuals and organizations acquiring residential property in Vietnam. Foreign investors are permitted to own houses and apartments for a maximum period of 50 years, with renewal options available.

Properties can be acquired either through new developments or on the secondary market, although the number of foreign-owned units is subject to quota restrictions (generally up to 30% of the total units in a condominium project). While foreigners cannot own land directly, they are granted leasehold rights over land use for residential purposes.

Importantly, foreign property owners are treated equally with local citizens when it comes to taxation. This includes responsibilities related to rental income, capital gains, VAT, and other taxes as outlined in this guide.

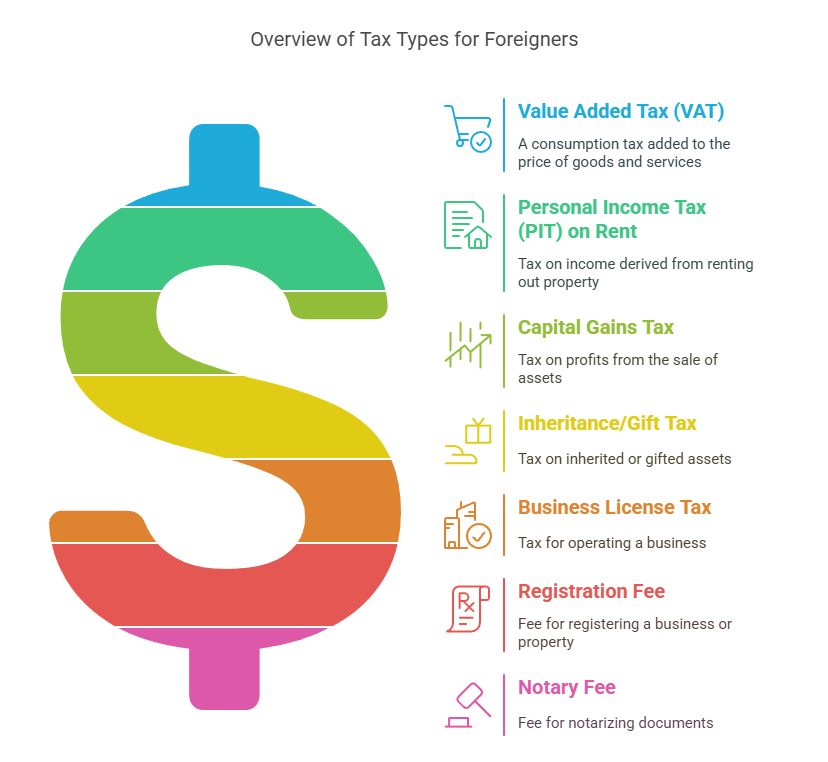

Summary of Applicable Taxes

Tax Type | Rate | When It Applies |

Value Added Tax (VAT) | 10% | Applied when purchasing from developers |

Personal Income Tax (PIT) on Rent | 5% + 5% VAT | When annual rental income exceeds VND 100 million |

Capital Gains Tax | 2% of sale price | When transferring ownership of a property |

Inheritance/Gift Tax | 10% | When property is inherited or gifted outside of immediate family |

Business License Tax | VND 300k–1 million/year | Based on total annual rental income |

Registration Fee | 0.5% | On registration of property ownership |

Notary Fee | 0.05%–0.1% | On notarized transaction value |

Tax on Rental Income

Rental income derived from leasing real estate in Vietnam is subject to both VAT and PIT if the annual revenue exceeds VND 100 million (~USD 4,000). These taxes apply regardless of whether the property owner is a resident or a non-resident.

Owners must also pay an annual business license tax. The threshold and tax rate are as follows:

- VND 300,000 for income between 100 and 300 million VND

- VND 500,000 for income between 300 and 500 million VND

- VND 1,000,000 for income over 500 million VND

It is mandatory to file tax declarations periodically (monthly, quarterly, or yearly), and late submission can lead to penalties and interest charges. In practice, many foreign landlords authorize local agents or property managers to handle tax filings and payments on their behalf. However, the legal responsibility still rests with the property owner.

Capital Gains Tax on Real Estate Transfer

When selling real estate in Vietnam, whether as a resident or a non-resident, capital gains tax is an inevitable component of the transaction.

- How it's calculated:

- In Vietnam, capital gains tax is typically calculated as 2% of the full contract value, regardless of whether the seller made a profit or not.

- This flat-rate method simplifies the process and avoids the need to prove the original purchase price, associated costs, or actual profit margins.

- Important notes:

- The tax must be declared within 10 days from the date of the notarized transfer agreement.

- In many transactions, buyers withhold and submit the tax on behalf of the seller as part of the contractual agreement.

Tax on Inheritance and Gifts of Real Estate

Foreign and local property owners alike may pass on their real estate holdings through inheritance or gifts, but such transfers are subject to taxation.

- Tax rate:

- A flat 10% Personal Income Tax applies to the market value of the property at the time of transfer.

- However, immediate family transfers are exempt, including between:

- Parents and children;

- Spouses;

- Grandparents and grandchildren;

- Siblings (if documented under local family law).

- Documentation required:

Proof of relationship (birth certificates, family registers, notarized declarations).

Certified notarized gift/inheritance contracts.

VAT and Registration Fee When Purchasing Real Estate

- VAT (Value Added Tax):

Imposed at 10% when purchasing new property directly from a developer.

For secondary market purchases (from individual owners), VAT usually does not apply.

- Registration Fee:

A 0.5% registration fee is charged on the total declared value of the property.

This is paid at the time of submitting the Land Use Rights Certificate (LURC) application.

If the declared value is too low, the tax office may apply the government-published land price index instead.

Notarization and Administrative Costs

All real estate contracts involving transfer of ownership must be notarized to be valid under Vietnamese law.

- Common fees include:

- Notary fee: 0.05% to 0.1% of the property value.

- Administrative fee for name registration: Varies by province, but typically under VND 1 million.

- Other document fees: Copies, translations, certification if necessary for foreign documents.

These are often split between buyer and seller unless otherwise agreed.

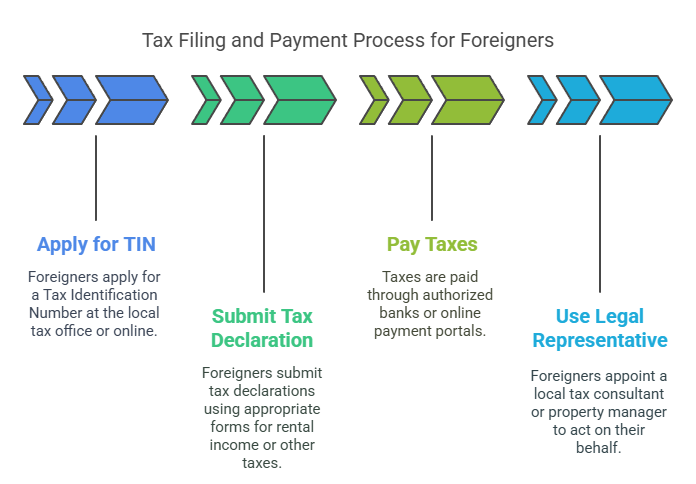

Step-by-Step: Real Estate Tax Filing and Payment Process for Foreigners

Step 1: Apply for a Tax Identification Number (TIN)

– Apply at local tax office or online at https://canhan.gdt.gov.vn

– Required documents: passport, notarized purchase/lease agreement, and filled form 05-DK-TCT.

Step 2: Submit Tax Declaration

– Use Form 01/TTS for rental income, and other relevant forms for transfer or inheritance taxes.

– Filing can be done monthly, quarterly, or annually, depending on income stability.

Step 3: Pay Taxes

– Can be paid via authorized banks or online payment portals.

– Always keep proof of payment and submission for at least 10 years.

Step 4: Use a Legal Representative

Foreigners often appoint a local tax consultant or property manager through a notarized power of attorney to act on their behalf.

Double Taxation Avoidance Agreements (DTAAs)

Vietnam has signed over 80 DTA treaties with countries like the US, UK, Japan, Australia, and Singapore to prevent double taxation.

- How it benefits foreign investors:

You may claim tax credits or deductions in your home country for taxes paid in Vietnam.

Some countries, like Singapore or UAE, do not tax foreign rental income at all, allowing 100% tax efficiency.

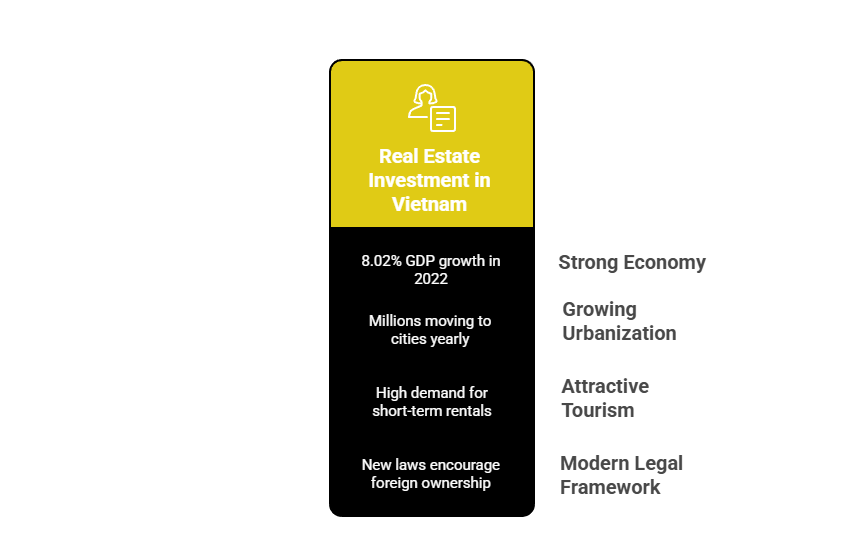

Why Real Estate Investment in Vietnam Is Booming?

Vietnam is no longer just a “low-cost manufacturing hub.” It is evolving into a real estate investment frontier thanks to:

✅ Strong economic fundamentals:

8.02% GDP growth in 2022.

Increasing FDI in manufacturing and infrastructure.

✅ Growing urbanization:

Millions moving into urban areas yearly → high demand for housing.

✅ Attractive tourism:

Cities like Da Nang, Nha Trang, and Phu Quoc drive demand for short-term rental properties.

✅ Modernizing legal framework:

New Housing Law (2023) encourages foreign ownership.

Clearer tax guidelines and online systems make compliance easier.

Conclusion: Navigating Vietnam’s Tax System as a Real Estate Owner

Investing in real estate in Vietnam can be highly profitable, but only if done legally and strategically.

Whether you’re renting out an apartment, flipping properties, or planning long-term capital growth, understanding your tax obligations is non-negotiable.

Final advice:

- Always consult with local lawyers and tax advisors.

- Keep thorough documentation.

- Plan for tax events like selling or inheritance.

- And don’t underestimate the value of proper compliance — it protects your assets and your peace of mind.

Leave A Comment