Table of Contents

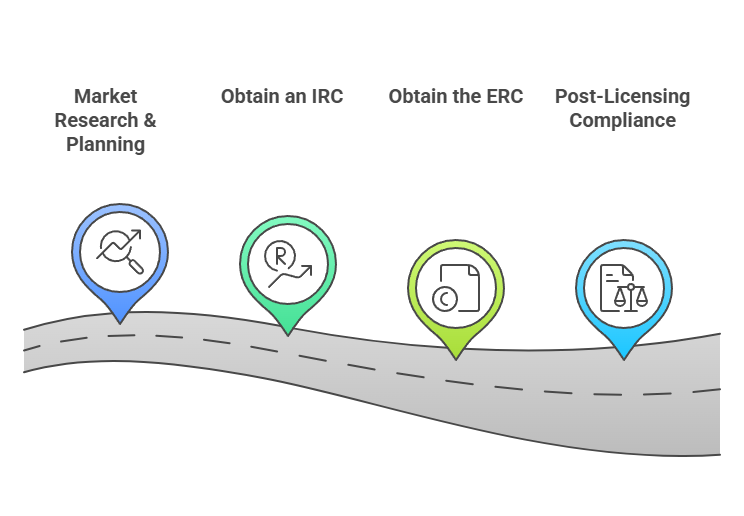

Step to Incorporate a Company in Vietnam

While it may seem well-structured at first, the process to incorporate a company in Vietnam can actually be quite daunting. Here’s how it typically unfolds:

- Step 1: Market Research & Planning

- Step 2: Obtain an Investment Registration Certificate (IRC)

- Step 3: Obtain the Enterprise Registration Certificate (ERC)

- Step 4: Post-Licensing Compliance

The journey of incorporating a company in Vietnam

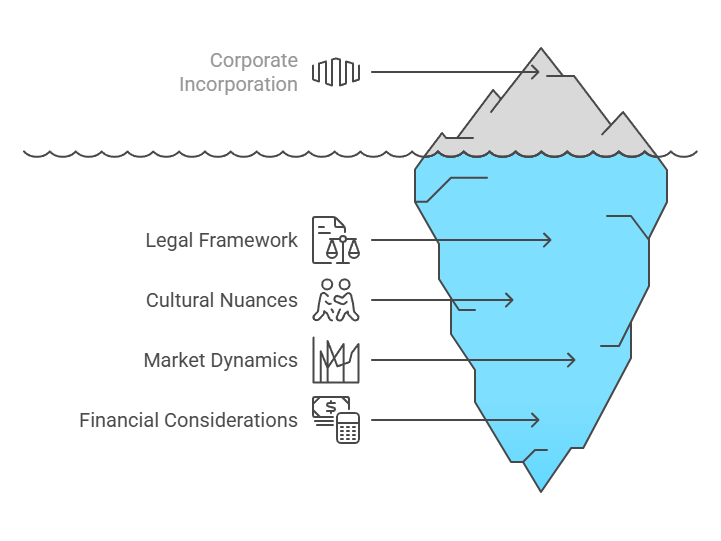

... it’s more complicated than it looks

Incorporating a company in Vietnam is often more complex than it seems. While the steps to incorporate a company in Vietnam may appear straightforward, foreign investors frequently encounter unexpected legal and procedural hurdles.

Incorporating a company in Vietnam is more complicated than it looks

Placing itself in the shoes of startup founders, SME owners, and multinational investors, thele.blog has crafted this practical, guide to support foreign investors navigating the company incorporation process in Vietnam. Let’s walk through the steps together.

Step 1: Select a business structure that aligns with your business model

While limited liability companies (LLCs) and joint stock companies (JSCs) are the two most common business forms chosen by foreign investors, it's essential to carefully evaluate your options when looking to incorporate a company in Vietnam.

Choosing the right structure during the company incorporation process can significantly impact your operations, legal responsibilities, and long-term business success.

Make sure your business structure fits your business model

Here are 10 key factors investors should consider when choosing a business form to incorporate a company in Vietnam:

- Liability of the Owner(s)

- Corporate Governance

- Share Transferability

- Capital Contribution & Adjustment

- Fundraising & Investment

- Potential Compliance & Reporting

- Requirements Number of Owners / Investors

- Business Scope & Scaling Charter

- Flexibility & Internal Rules

- Regulatory Perception in Vietnam

>>> Explore 11 Business Structures in Vietnam here.

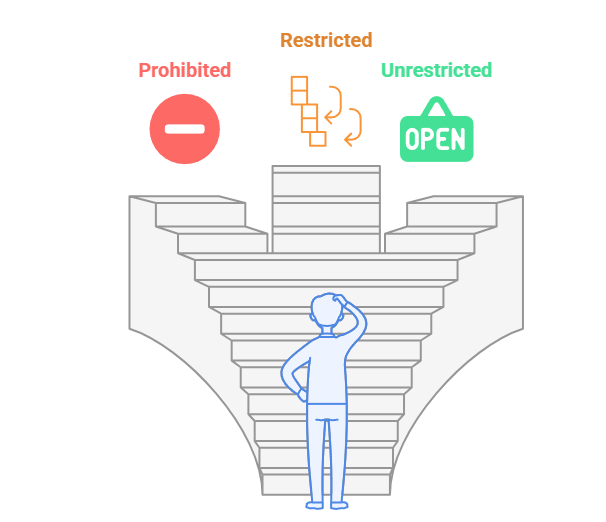

Step 2: Check if Your Business Sector Allows Foreign Investors

One of the most time-consuming and complex steps in incorporating a company in Vietnam is checking whether your business sector is open to foreign investment. This complexity arises because eligibility can depend on the investor's country of origin or specific conditions tied to the sector itself.

In other words, confirming whether your intended sector is open to foreign investment is not always straightforward. Under Vietnam’s legal framework, foreign investors are permitted to incorporate a company in Vietnam in any sector not included in either of the following:

(i) the list of prohibited business sectors, or

(ii) the list of 84 conditional sectors where foreign investment is restricted or subject to specific requirements.

As such, if your target business sector falls under restricted categories, it may take longer and/or incur higher costs than usual. One alternative route to consider is investing through a nominee structure, where a local partner holds ownership on your behalf, in compliance with local laws.

Market Access Matters When Incorporating a Company in Vietnam

Step 3: Engage a Legal Expert for Guidance

Engaging a legal expert early on can save you considerable time, effort, and potential headaches throughout the process of incorporating a company in Vietnam. Here are some key reasons why it's highly beneficial:

5 Reasons Why You Should Engage a Legal Expert to Incorporate Your Company in Vietnam

- Clear Roadmap:

A legal expert will provide you with a clear and structured roadmap for incorporating a company in Vietnam, helping you avoid delays or mistakes that can arise when you incorporate a company in Vietnam.

- Expert Advice:

As a foreign investor, you may have many questions or uncertainties about the legalities involved in incorporating a company in Vietnam, from choosing the right business structure to understanding tax implications. A legal expert can offer comprehensive advice, clarifying any doubts and providing insights tailored to your specific needs.

- Cost-Effective Legal Support:

Contrary to what many may think, hiring a legal expert in Vietnam is often more affordable than in other countries. Many Vietnamese lawyers don’t charge by the hour for initial consultations, making legal advice accessible even at the early stages of your venture to incorporate a company in Vietnam.

- Navigating Complex Regulations:

Vietnam’s legal landscape can be tricky, especially when it comes to foreign investment regulations. With thele.blog’s in-depth knowledge and experience assisting foreign investors, you can avoid costly mistakes during the process to incorporate a company in Vietnam.

In summary, engaging a legal expert is an investment in ensuring that your company is set up correctly and efficiently when you incorporate a company in Vietnam, with the right legal framework in place from day one.

Step 4: Secure a Lease for Corporate Incorporation

Securing a lease is a key part of incorporating a company in Vietnam. The lease could be for a physical office, a residential property, or even a virtual office, depending on the specific needs of your business.

It is important to note that, under Vietnamese law, investors are not permitted to use apartment units as the registered address of a company.

An apartment unit cannot be used to register a company in Vietnam

The lease agreement can initially be signed by individual investors to meet the documentation requirements for incorporation. After the company is formally established, the lease can be reassigned and signed by the newly incorporated company and the lessor.

thele.blog has a strong network of contacts and can help match your specific lease requirements, ensuring you find the ideal space to support your business operations.

Step 5: Prepare the Necessary Documents

Document preparation is often the toughest part of incorporating a company in Vietnam, especially when dealing with paperwork from different countries.

All documents must be physically signed (wet ink). As such, foreign documents - such as IDs, financial documents, and powers of attorney need to be consular legalized, a step that can take time but is essential for acceptance by Vietnamese authorities when you incorporate a company in Vietnam.

Working closely with your lawyer is crucial, as even small errors can cause delays. Ensuring all documents are properly prepared and legalized will help avoid unnecessary setbacks and keep your company incorporation on track.

Document preparation is often the toughest part of incorporating a company in Vietnam

Step 6: Obtain an Investment Registration Certificate (IRC)

Once your document dossier is ready, the next step in incorporating a company in Vietnam is obtaining an Investment Registration Certificate (IRC). Depending on your business location, you will need to submit your application either to the Department of Planning and Investment (DPI) or the Board of Industrial Management.

Typically, an IRC is issued within 15 working days after the authorities receive the complete documentation. However, it’s important to anticipate some potential delays, especially during peak periods or if there are any issues with the documents submitted.

To streamline the process of incorporating a company in Vietnam, our experienced lawyers submit the application online via the the national portal for enterprise registration. This allows for preliminary approval of the dossier before physical copies are submitted to the authorities, helping to avoid common delays and ensure smoother approval.

Step 7: Obtain an Enterprise Registration Certificate (ERC)

After obtaining the Investment Registration Certificate (IRC), the next important step to incorporate a company in Vietnam is securing the Enterprise Registration Certificate (ERC). This certificate officially registers your company, allowing you to legally conduct business operations in the country.

The process to obtain an ERC is much quicker and simpler compared to the IRC. Typically, it only takes about 3 working days, and the documentation required is far less complex.

You can complete the entire ERC application online through the official government portal at https://dangkykinhdoanh.gov.vn/pages/trangchu.aspx, making this step one of the more streamlined parts of the process to incorporate a company in Vietnam.

Step 8: Complete Post-Licensing Procedures

You’re almost there! There are just a few final administrative tasks to complete before you can officially launch your business and start operations in Vietnam.

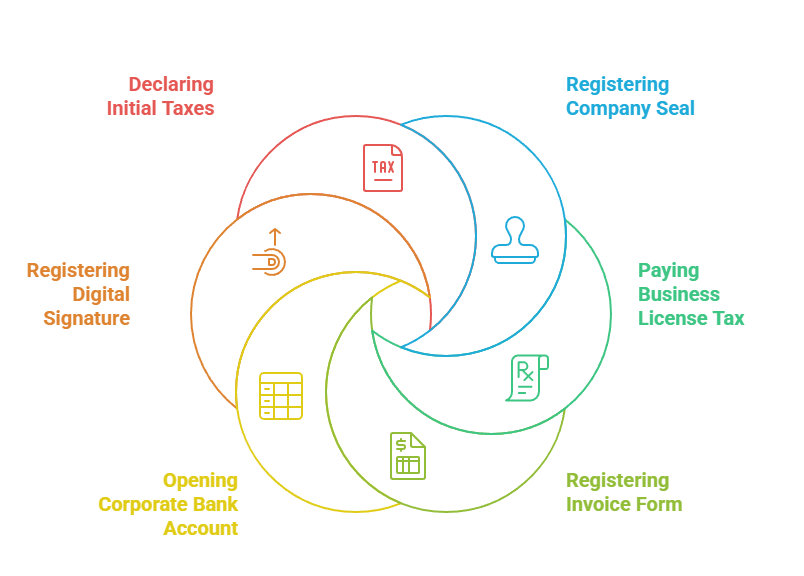

These post-licensing procedures include:

- Registering your company seal

- Paying the business license tax

- Registering your invoice form

- Opening a corporate bank account

- Registering a digital signature

- Declaring initial taxes

The post-licensing procedure is the final step in incorporating a company in Vietnam – don’t forget to complete it!

Once these steps are done, congratulations – you’ve successfully navigated the full process to incorporate a company in Vietnam! You’re now ready to launch your business and bring your plans to life in one of Southeast Asia’s most dynamic markets.

Step 9 (Optional): Obtain Sector-Specific Operational Licenses

This requirement only applies to specific industries - such as education, healthcare, food and beverage, fintech, or logistics - and is not part of the standard process to incorporate a company in Vietnam.

If it applies to your business, consult your legal advisor to prepare and submit the necessary documents to obtain the relevant operational permits or licenses.

Step 10: Inject Charter Capital

Within 90 days of receiving the Enterprise Registration Certificate, investors must inject the committed charter capital into the company’s Direct Investment Capital Account (DICA) at a licensed Vietnamese bank.

Timely capital injection is essential - it enables future profit remittance and ensures compliance with investment regulations.

Failure to meet the deadline may lead to administrative fines and require an amendment to the Investment Registration Certificate (IRC).

Why thele.blog?

After walking through the full journey to incorporate a company in Vietnam, one thing should be clear - it’s not just about ticking boxes. It’s about understanding the system, anticipating challenges, and making the right moves at the right time.

That’s where thele.blog comes in.

- Experience that matters

With deep local knowledge and years of experience assisting foreign investors, we know how to navigate Vietnam’s legal and practical landscape - and how to help you avoid the common pitfalls.

- Time-saving support

We streamline the process so you don’t waste weeks figuring things out on your own. From step one to post-licensing tasks, we keep your timeline on track.

- Clear, practical advice

We keep things simple. No legal jargon, just straightforward answers and solutions that work for your specific situation.

- Affordable and transparent

Our pricing is fair and upfront - and most initial consultations come at no cost. We believe good legal support shouldn’t come with hidden fees or surprises

- Strong local network

Whether it’s finding a lease, opening a bank account, or handling sector-specific permits, our connections across Vietnam help turn obstacles into easy wins.

How thele.blog Navigates Vietnam’s Business Landscape for Foreign Investors

Ready to Incorporate Your Company in Vietnam?

Whether you’re just starting to explore or are ready to begin, we’re here to help.

Contact us today to schedule your free consultation and get personalized advice on incorporating your company in Vietnam. Let’s make your business goals a reality!

Reach out to us at:

📞 Telephone: +84 81235 3839

📧 Email: thele.blog@thele.blog

📱 Hotline: +84 916 545 618

Leave A Comment