Company Incorporation Costs in Vietnam

This article outlines the company incorporation costs in Vietnam, giving businesses a clear understanding of the expenses involved. From registration fees and licensing charges to post-incorporation costs, understanding these detailed company incorporation costs in Vietnam helps businesses plan their finances effectively and minimize unexpected financial risks.

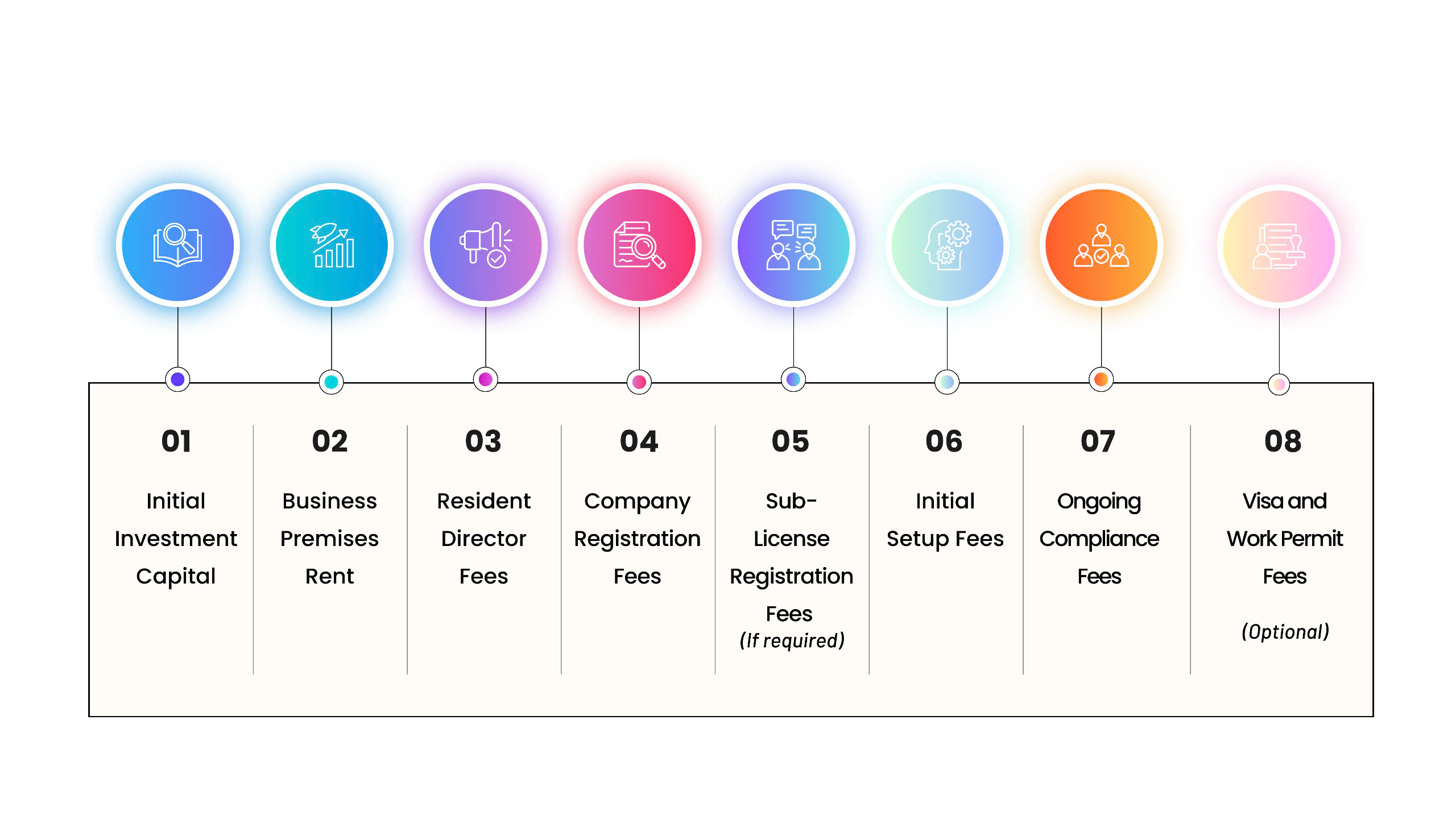

A Breakdown of Company Incorporation Costs in Vietnam

Initial Investment Capital

Initial capital investment forms a significant portion of company incorporation costs in Vietnam. This investment is required for the business to operate until it becomes self-sustaining.

There is no single correct answer to how much initial investment capital is sufficient, as it depends on various factors such as the scale of the investment project, business sectors, and the legal framework. However, to help investors anticipate sufficient company incorporation costs in Vietnam, the following points provide useful guidance:

- Firstly

for most businesses, there is no mandatory minimum capital requirement. Unless the business falls within certain sectors subject to minimum capital requirements – such as banking, finance, marine, or stock trading – investors can mobilize minimal initial investment capital. Understanding the company incorporation costs in Vietnam in these sectors is essential.

- Secondly

while many investors opt for a minimum investment capital of USD 10,000, it is possible for companies with lower capital (ranging from USD 3,000 to USD 5,000) to be successfully registered, particularly in service-based industries like consulting and IT. The company incorporation costs in Vietnam can thus vary significantly depending on the business type.

- Thirdly

the level of investment capital can impact eligibility for long-term visas and residence permits for foreign investors. The higher the investment capital, the greater the likelihood of obtaining long-term stay permits. As such, it may not be advisable to lower the initial investment capital, as this could raise concerns with government officers about the investment project's viability.

- Thirdly

the committed capital must be fully contributed within 90 days of company incorporation in Vietnam. Failure to fulfill the capital contribution obligation within the prescribed period may result in penalties for both the company and the investor under Vietnamese law.

Initial investment capital plays an essential role in shaping the company incorporation costs in Vietnam.

Business Premises Rent

According to regulations, a company must have a legally registered business address, which must be different from a residential address. This means that investors need to factor in the cost of securing a business address as part of the company incorporation costs in Vietnam.

The good news is that businesses may opt for a virtual office for company registration, especially in the initial stage when a physical location is not yet necessary.

The cost of renting a virtual office depends on the location and the grade of the building, typically ranging from USD 400 to USD 800 per year. Virtual offices in Grade A+ buildings located in central business districts may have higher costs, ranging from USD 1,000 to USD 1,900 per year.

Businesses may opt for a virtual office to help minimize company incorporation costs

A virtual office service includes the right to use the address for company registration and the display of the company’s name at the registered location. However, this fee does not cover the use of actual office space or meeting rooms within the the premises.

If a business requires a fixed workspace (such as an office, retail store, or factory), it must secure a suitable location and sign a lease agreement before proceeding with company registration.

The rental prices for commercial real estate vary depending on the city and type of property. The table below provides an overview of commercial property rental costs in major cities in Vietnam as of Q3/2024:

Commercial Properties | Hanoi | Ho Chi Minh City | Da Nang | |

Office Space (per m²/month) | Grade A | $23 – $47 | $39 – $65 | $21 – $32 |

Grade B | $16 – $35 | $19 – $55 | $10 – $17 | |

Grade C | From $9 | From $9 | Từ $8 | |

Industrial Land (per m²/lease term) | $95 – $280 | $100 – $250 | $90 – $95 | |

An overview of commercial property rental costs in major cities in Vietnam as of Q3/2022

To conclude, when it comes to company incorporation costs in Vietnam, the cost of business premises can vary significantly – from virtual offices to physical locations, and from residential-style spaces to industrial properties. Investors must carefully consider where to register their business and how much they can allocate in order to properly plan for company incorporation costs in Vietnam

Resident Director Fees

One key driver of company incorporation costs in Vietnam is the requirement to appoint a Resident Director during registration and operation. If you’re not based in Vietnam, you must authorize or engage a third party – such as a trusted friend or family member who is either a Vietnamese national or a foreign resident – to take on this role. By nominating someone you already know, you can help keep your incorporation costs in Vietnam down. Remember, the Resident Director serves as the company’s legal representative but does not need to hold any shares.

The Resident Director service fee typically ranges from USD 250 to USD 450 per month when outsourcing this position.

Don’t forget to include resident director fees as part of your company incorporation cost plan in Vietnam

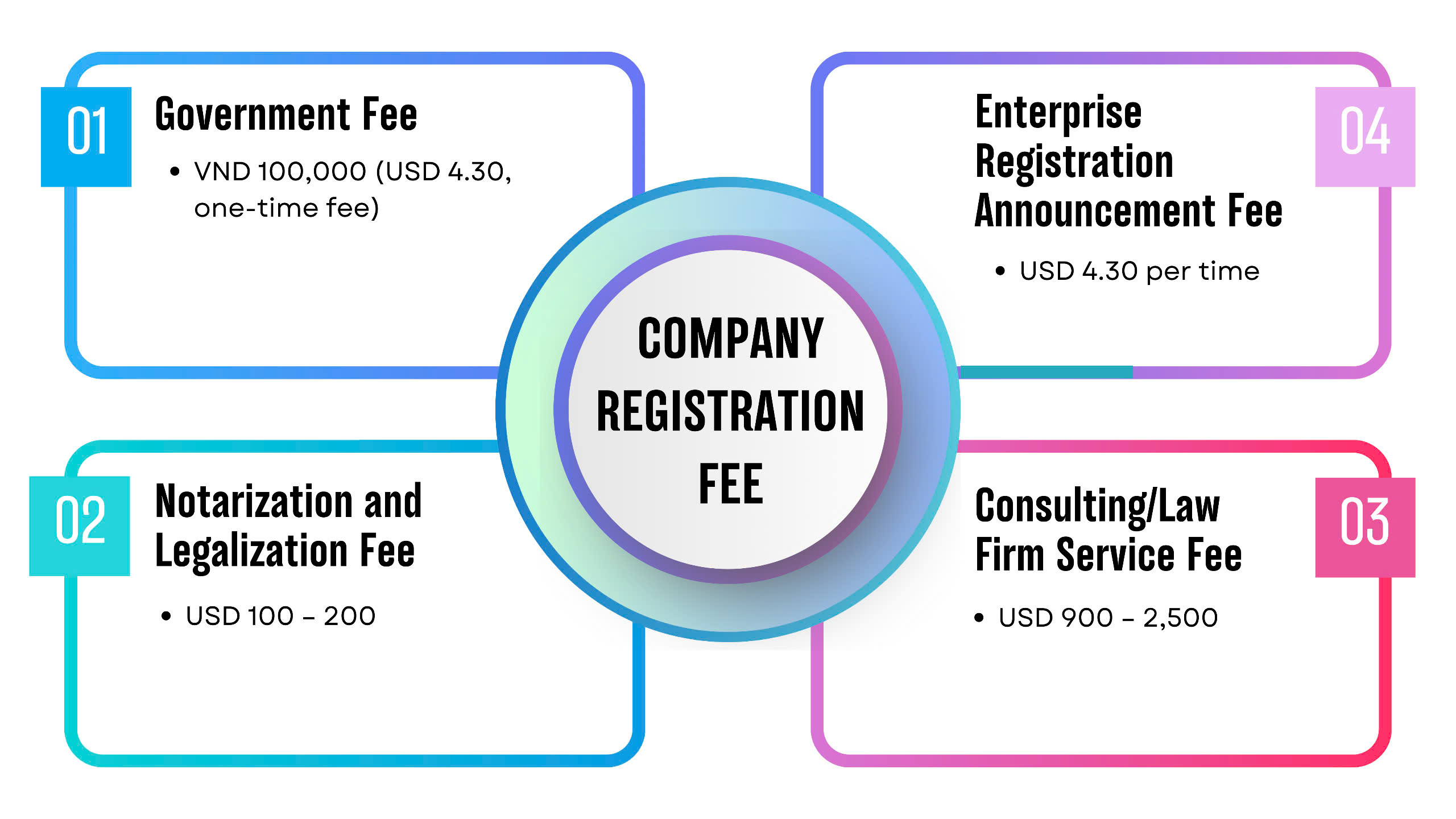

Company Incorporation Costs

Although most investors inquire about the cost of company incorporation in Vietnam, the costs are relatively low, as the government supports and encourages investment.

This Company Incorporation Costs include document preparation fees (notarization and legalization), government fees, and service fees paid to professional service providers or agencies handling the registration process.

- Government Fee: VND 100,000 (USD 4.30, one-time fee)

- Notarization and Legalization Fee: USD 100 – 200

- Enterprise Registration Announcement Fee: VND 100,000 per announcement (USD 4.30 per time)

Additionally, within 30 days after obtaining the Enterprise Registration Certificate (ERC), companies must publish their registration details on the National Business Registration Portal. The official publication fee is VND 100,000 per announcement (USD 4.30 per time).

- Consulting/Law Firm Service Fee: USD 900 – 2,500

The company registration process can be complex, especially for foreign investors. Required documents often involve legal terminology and business regulations, making professional legal assistance highly advisable. For conditional business sectors (such as recruitment services, logistics, and tourism), service fees are higher, and processing times are longer due to additional licensing requirements. Legal service providers may offer customized incorporation packages, including Bank account setup; Initial tax registration; Investment Registration Certificate (IRC) application; Enterprise Registration Certificate (ERC);…v..v..

When selecting a service provider, businesses should balance cost and quality. Opting for the cheapest service may result in higher risks and unexpected expenses in the long run.

Company Registration Fees

For more information regarding to Company Registration, please visit 4 steps to set up a company in Vietnam.

Sub-License Registration Fees (If required)

Certain conditional business sectors require companies to obtain additional licenses or regulatory approvals before commencing operations. For example:

- Foreign Direct Investment (FDI) companies engaged in retail business must obtain a Retail Business License.

- Restaurants must acquire a Certificate of Food Safety and Hygiene.

- Importing cosmetic products requires a Notification of Cosmetic Product Registration.

The costs associated with sub-license registration vary depending on the type of license and the complexity of the approval process.

Initial Setup Fees

Once a company is legally established, it must comply with post-incorporation requirements, which involve certain associated costs.

- Bank Account Fee

Commercial banks in Vietnam generally do not charge a fee for opening a corporate bank account. However, most banks require businesses to maintain a minimum balance, which varies depending on the bank. The standard minimum balance is typically VND 1,000,000 (approximately USD 39.7).

Additional banking service fees may apply, depending on the type of transactions and account usage.

Bank Account Fee

- Accounting and Social Insurance Initial Setup Fee

Every company in Vietnam is required to obtain a digital signature for conducting electronic administrative transactions. The cost of a digital signature varies depending on the service provider and the validity period. Typically, a three-year digital signature costs around USD 100.

Digital signature for conducting electronic administrative transactions

Additionally, businesses may need to purchase supporting software, such as:

- Accounting software to record and manage financial transactions.

- Social insurance software if the company has employees participating in the mandatory social insurance scheme.

- Value-added tax (VAT) invoices if the business is required to issue VAT invoices to customers.

The exact costs for these software and services depend on the business’s needs and operational scale.

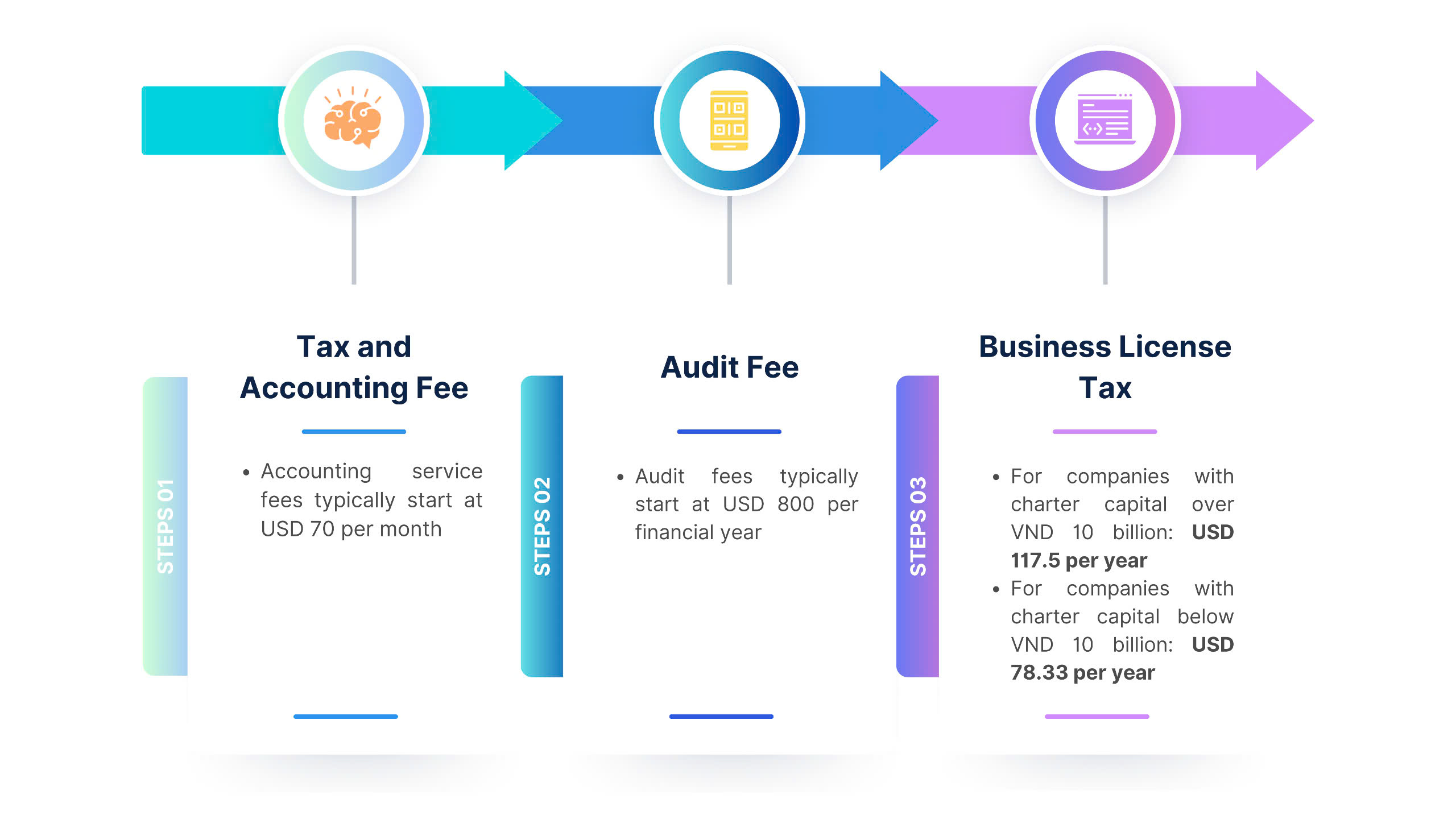

Ongoing Compliance Fees

Ensuring ongoing legal compliance in Vietnam requires businesses to incur annual recurring costs, particularly for tax reporting and auditing.

- Tax and Accounting Fee

All companies in Vietnam are required to declare and submit tax reports either monthly or quarterly, as well as finalize corporate income tax (CIT) at the end of the financial year.

- For companies with charter capital over VND 10 billion: VND 3,000,000 per year (USD 117.5 per year).

- For businesses with a high accounting workload (such as manufacturing or retail companies), hiring an in-house accounting team is often necessary.

- For businesses with a low to moderate accounting workload, outsourcing accounting services can provide access to specialized expertise at a more cost-effective rate.

Accounting service fees typically start at USD 70 per month, but the actual costs for bookkeeping and tax filing services may vary depending on business size and service quality requirements.

- Audit Fee

For foreign-invested enterprises (FDI companies), the annual financial statements must be prepared by the accounting department and audited by an independent auditing firm in Vietnam.

Auditing is a mandatory requirement to ensure financial transparency and compliance with accounting and tax regulations.

- Audit fees typically start at USD 800 per financial year.

- However, the actual cost depends on the company’s size and the complexity of its financial statements.

Maintaining tax and audit compliance not only helps businesses avoid legal risks but also facilitates business operations and investment expansion in Vietnam.

- Business Tax

The annual business tax is determined based on a company’s charter capital and is classified into two tiers:

- For companies with charter capital over VND 10 billion: VND 3,000,000 per year (USD 117.5 per year).

- For companies with charter capital below VND 10 billion: VND 2,000,000 per year (USD 78.33 per year).

Note: According to Decree No. 22/2020/ND-CP, amending Decree No. 136/2016/ND-CP, companies established in 2021 are exempt from the business license tax in the first year of incorporation.

Ongoing Compliance Fees

Visa and Work Permit Fees (Optional)

If a foreign investor wishes to reside in Vietnam long-term to manage their business, they may apply for a Temporary Residence Card (TRC) with a validity of up to 10 years.

A Specimen Vietnam Temporary Residence Card

Unless exempted, foreign nationals working in Vietnam must obtain a Work Permit. A Work Permit is valid for two years and can be renewed. Once the Work Permit expires, the foreign employee may apply for a Work Visa or a Work TRC, both of which have a maximum validity of two years.

A Specimen Work Permit

The visa and work permit application process is complex and involves extensive documentation and strict procedures. As a result, businesses and foreign investors often seek professional assistance from consulting firms to handle the application process.

The service fee for obtaining a visa or work permit typically starts at USD 400 per application.

For details of the work permit procedure, please refer to Obtaining a Work Permit In Vietnam.

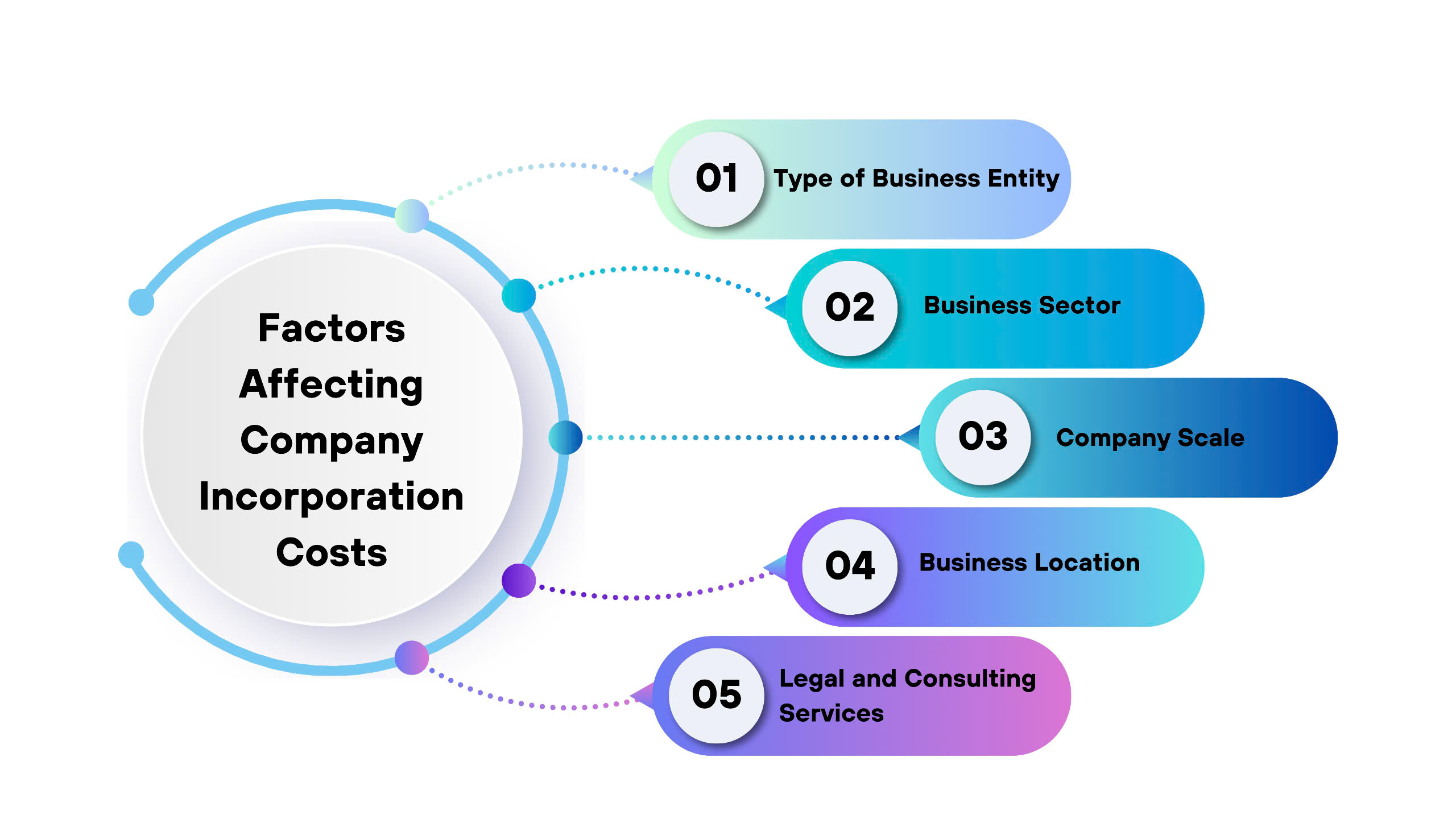

Factors Affecting Company Incorporation Costs

The cost of company incorporation in Vietnam can vary depending on several factors, including:

- Type of Business Entity: Different business structures (e.g., Limited Liability Company (LLC), Joint Stock Company (JSC)) have distinct legal requirements and registration procedures, leading to variations in costs.

- Business Sector: Conditional business sectors require additional sub-licenses, increasing both costs and processing time.

- Business Location: Rental costs for business premises vary based on location and property type.

- Company Scale: The investment capital, number of employees, and operational scope influence management, accounting, and compliance costs.

- Legal and Consulting Services: Engaging a law firm or consulting service can streamline the registration process, but it also incurs additional service fees.

Factors affecting company incorporation costs

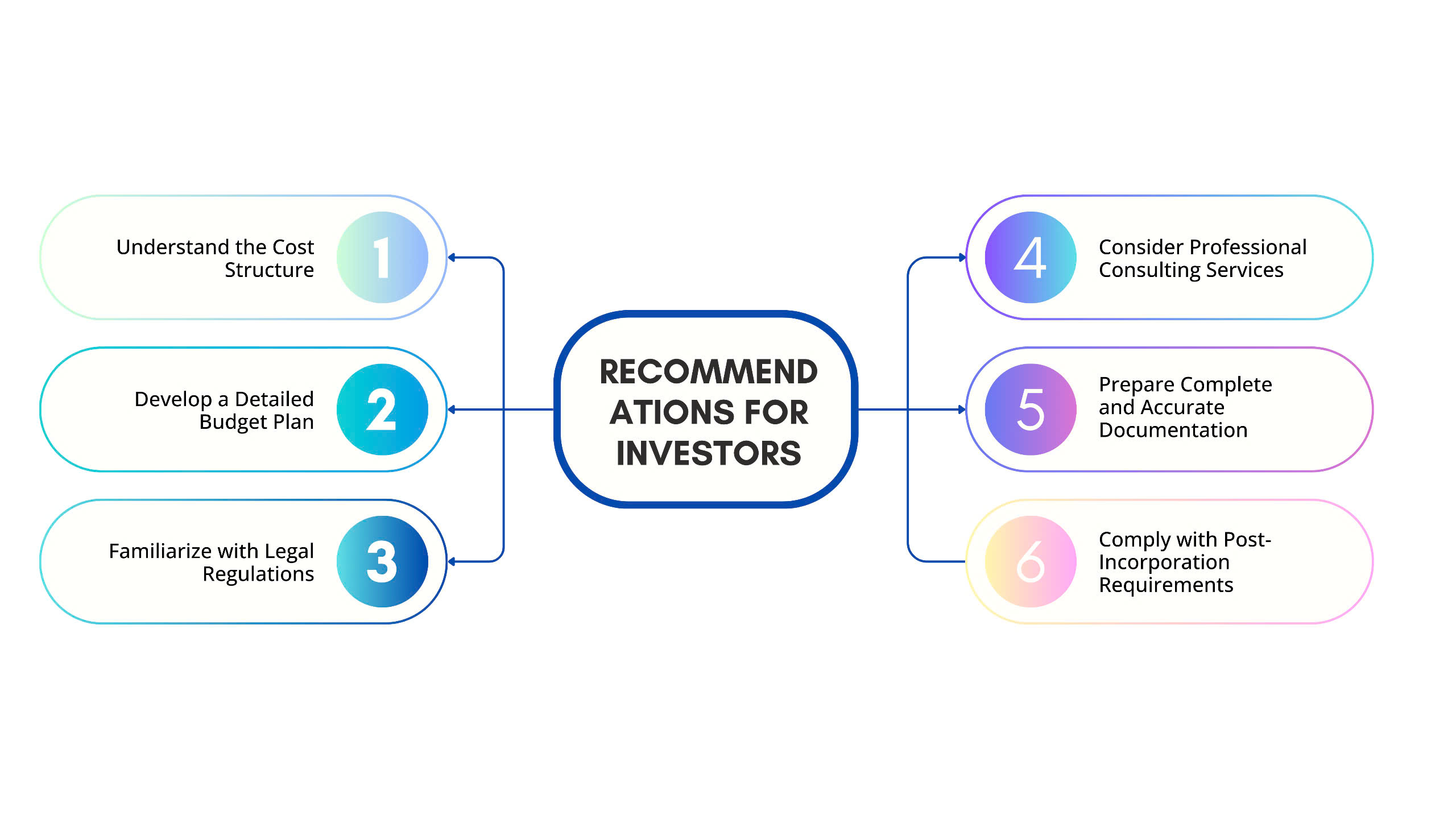

Recommendations for Investors

Recommendations for Investors

Understand the Cost Structure

Before initiating the business registration process, investors should have a clear understanding of the cost components, expected expenses, and influencing factors.

Develop a Detailed Budget Plan

A well-structured budget plan helps investors control costs and avoid unexpected financial burdens.

Familiarize with Legal Regulations

Understanding the legal requirements for company incorporation and business operations ensures compliance and mitigates legal risks.

Consider Professional Consulting Services

Engaging reputable and professional law firms or consulting services can save time and effort, ensuring a smooth incorporation process.

Prepare Complete and Accurate Documentation

Proper preparation of all required documents minimizes processing delays and prevents additional costs.

Comply with Post-Incorporation Requirements

After incorporation, businesses must adhere to tax, accounting, and compliance regulations to avoid legal risks and maintain stable operations.

Conclusion

The total cost of company incorporation in Vietnam starts from USD 5,000 or more (excluding Initial Investment Capital) in the first year. This amount may vary depending on the business sector, company size, and business location.

Category | Estimated Cost | Notes | ||

Initial Investment Capital | USD 10,000 | Businesses with lower capital (USD 3,000 – 5,000) may still be registered | ||

Business Premises Rental |

| |||

Virtual Office | USD 400 – 800/year | Grade A+ buildings in central districts may cost USD 1,000 – 1,900/year | ||

Physical Office | Office Space | Grade A | Average USD 38/m²/month | Available in major cities (Hanoi, Ho Chi Minh City, Da Nang) |

Grade B | Average USD 25/m²/month | |||

Grade C | Average USD 9/m²/month | |||

Industrial Land | USD 152/m² (lease term) | |||

Resident Director Fees | USD 250 – 450/month | Required if the investor does not reside in Vietnam | ||

Company Registration Fees |

|

| ||

Government Fee | USD 4,30 | One-time | ||

Notarization & Legalization Fees | USD 100 – 200 |

| ||

Business Registration Consulting/Service Fees | USD 900 – 2,500 |

| ||

Enterprise Registration Announcement Fee | USD 4,30 per announcement | Businesses must publish their registration details within 30 days | ||

Initial Setup Fees |

| |||

Bank Account Fee | USD 39,7 | Some banks require a minimum balance | ||

Digital Signature for E-Tax Filing | USD 100 | Valid for 3 years | ||

Accounting Services | From USD 70/month |

| ||

Ongoing Legal Compliance Fees |

| |||

Audit Fees | USD 800/year | Costs depend on business size and complexity | ||

Business License Tax | Charter Capital Over VND 10 Billion USD 117,5/year | Enterprises established in 2021 are exempt from business license tax in the first year | ||

Charter Capital Below VND 10 Billion USD 78,3/year | ||||

Visa and Work Permit Fees (Optional) | USD 400 per application |

| ||

🇻🇳 Thinking of Establishing a Business in Vietnam? Here’s What You Need to Know! 💼🚀

Starting a business in Vietnam isn’t just about having capital – it’s about smart financial planning and a deep understanding of legal regulations. Knowing the key cost components, potential expenses, and legal requirements will help you make informed decisions and streamline the incorporation process.

🔍 Want to minimize risks and ensure a smooth setup? Working with legal experts and trusted consulting firms can be the game-changer for your business success in Vietnam.

📩 Let’s Get Started!

📞 Call/WhatsApp: (+84) 81235 3839

📧 Email: thele.blog@thele.blog

🌐 Learn More: www.thele.blog

Leave A Comment