Business structures in Vietnam

Wondering about investing in Vietnam but unsure which business structure is right for you? This article, "11 Business Structures in Vietnam: Which One is Right for You?" has everything you need to make an informed decision.

Which business structures in Vietnam is right for you?

In this article, thele.blog:

- Introduces 11 business structures available in Vietnam.

- Provides key details for each business structure to help you understand their unique features.

- Presents a comparison table for easier reference and comparison of all structures.

- Recommends the most suitable business structure based on your specific needs.

For clarity, in Vietnam, the term “business structure” is used interchangeably with “business form,” “business type,” or “business vehicle.” In this context, it refers to a vehicle that enables investors to conduct their business.

Let’s get it started!

11 business structures in Vietnam

To start a business in Vietnam, investors can consider one of 11 common business structures, including:

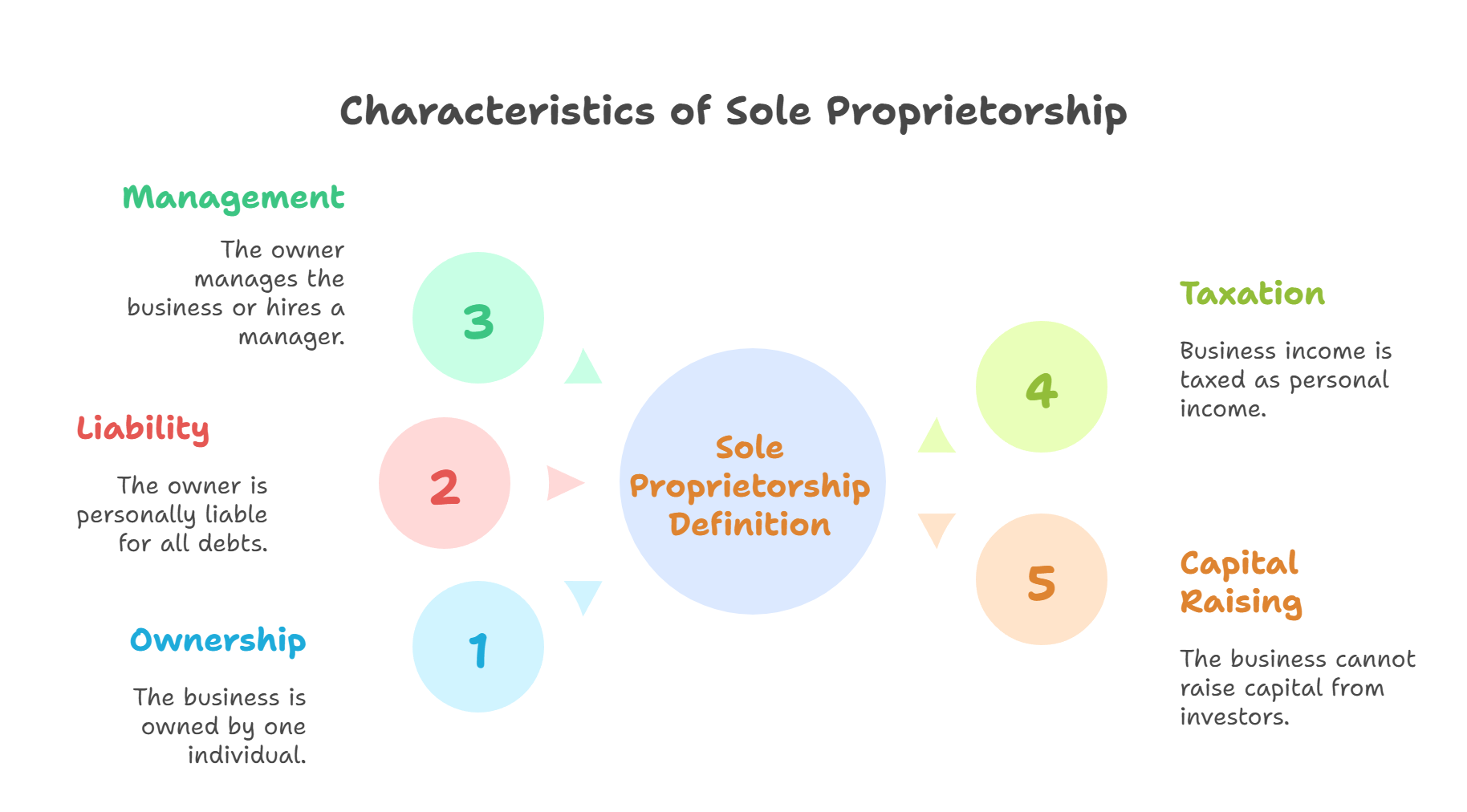

- Private Enterprise or Sole Proprietorship

A business structure owned and operated by a single individual. The owner has unlimited liability for debts and obligations.

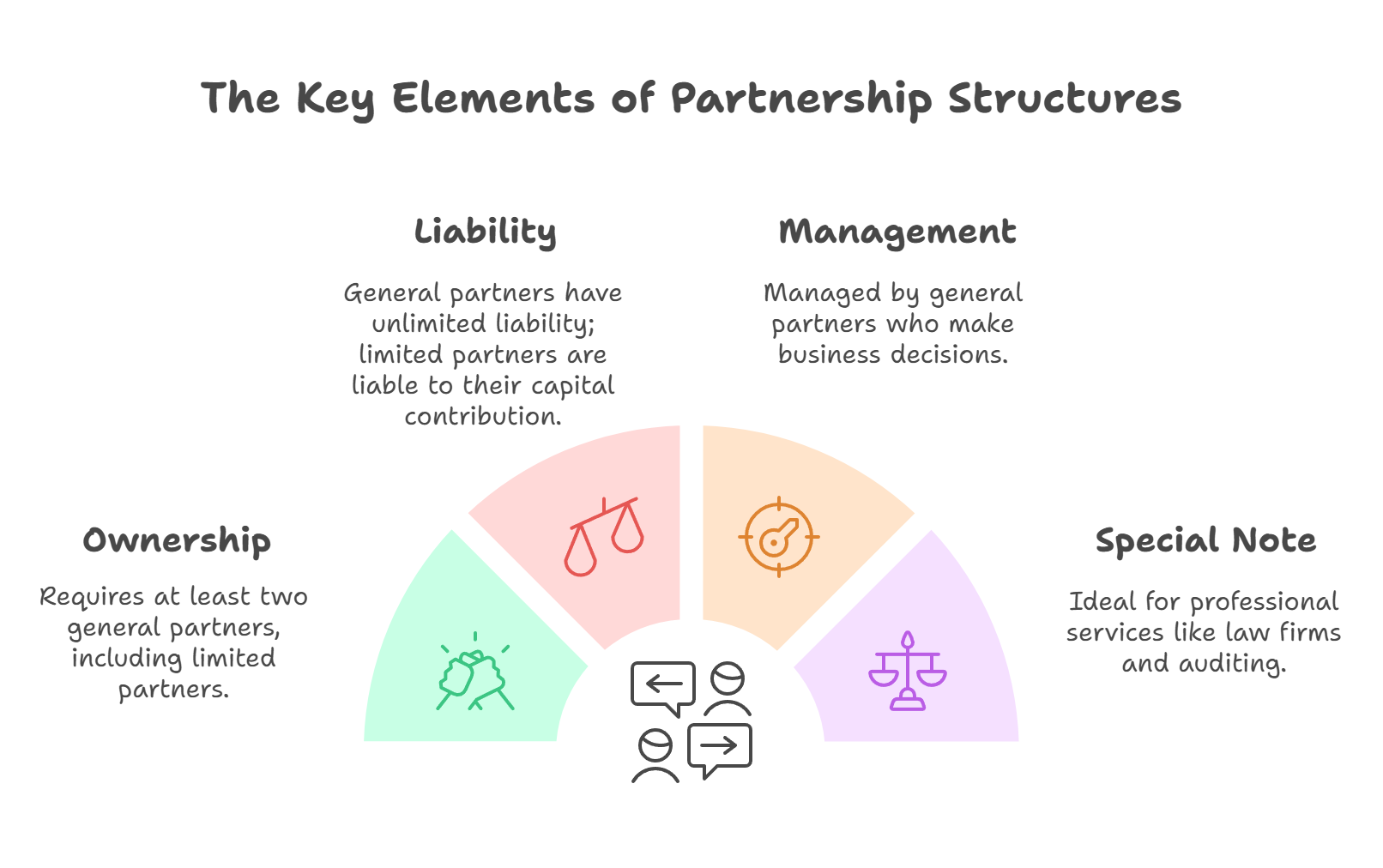

- Partnership

A business form established by at least two partners who are co-owners and share responsibilities. There are general partners (unlimited liability) and limited partners (limited liability).

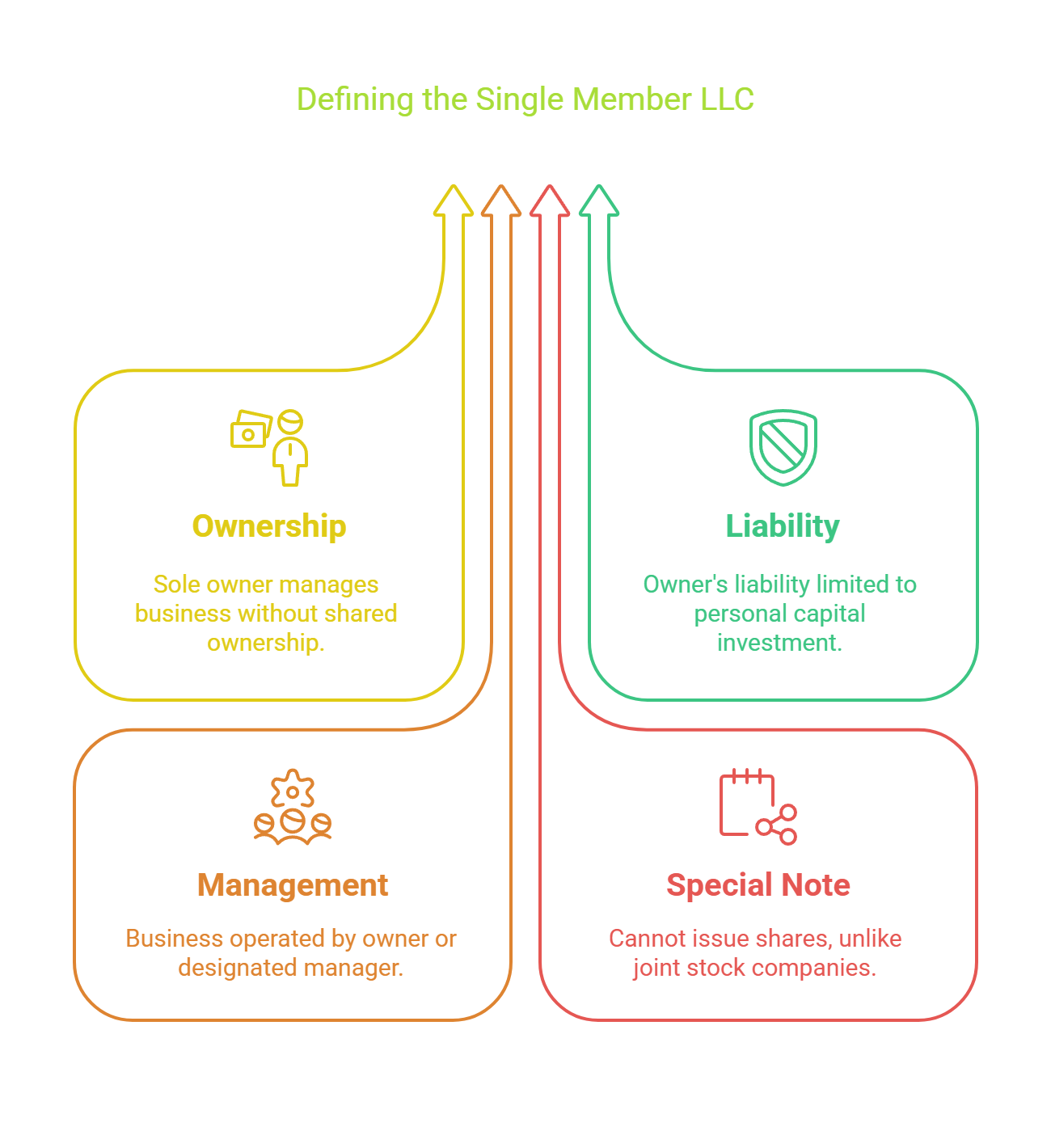

- Single-member LLC

A business type owned by one entity or individual. The owner has liability limited to their capital contribution.

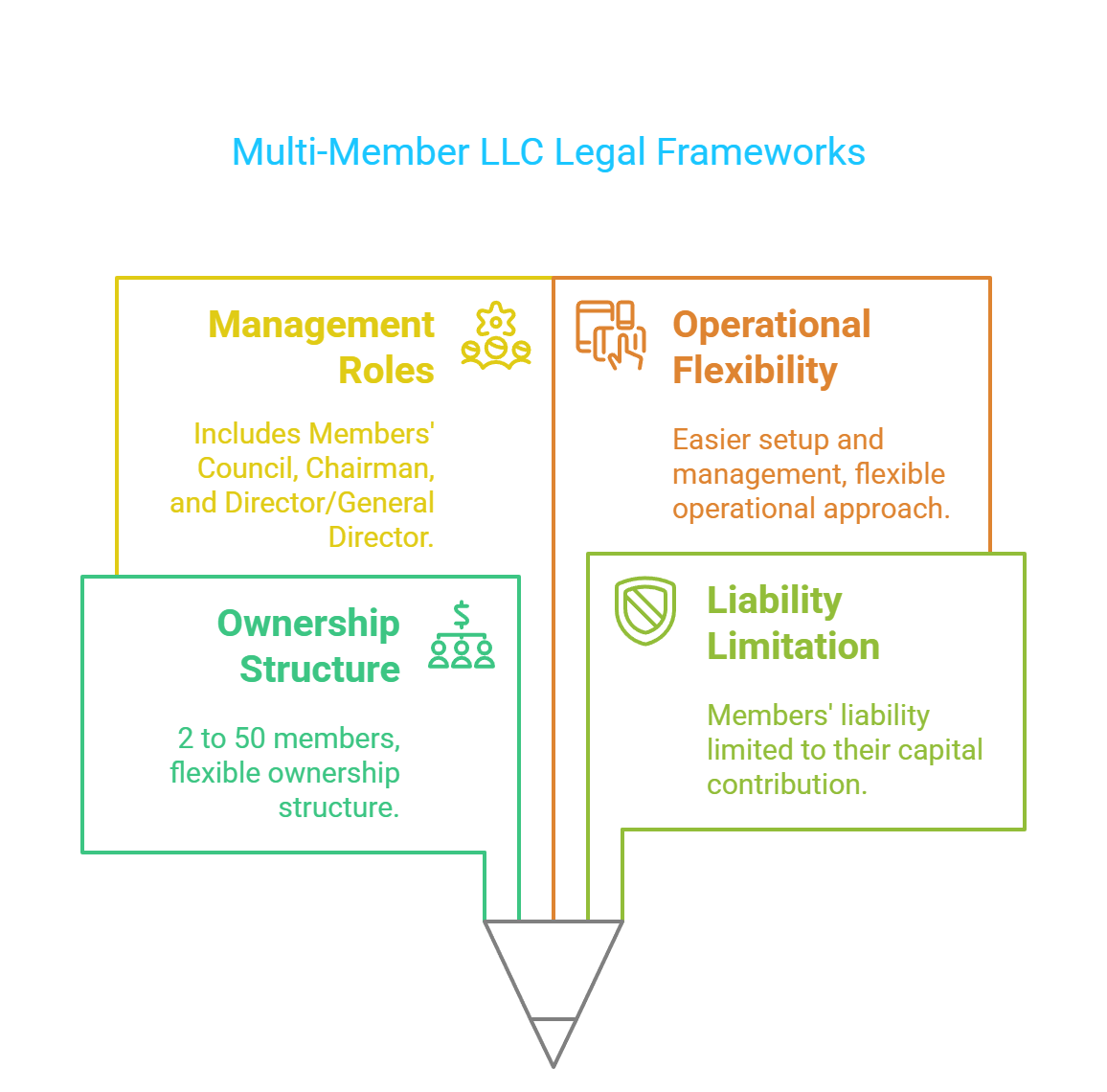

- Multi-member LLC

A business structure owned by and between 2 to 50 members, with liability limited to their contributions.

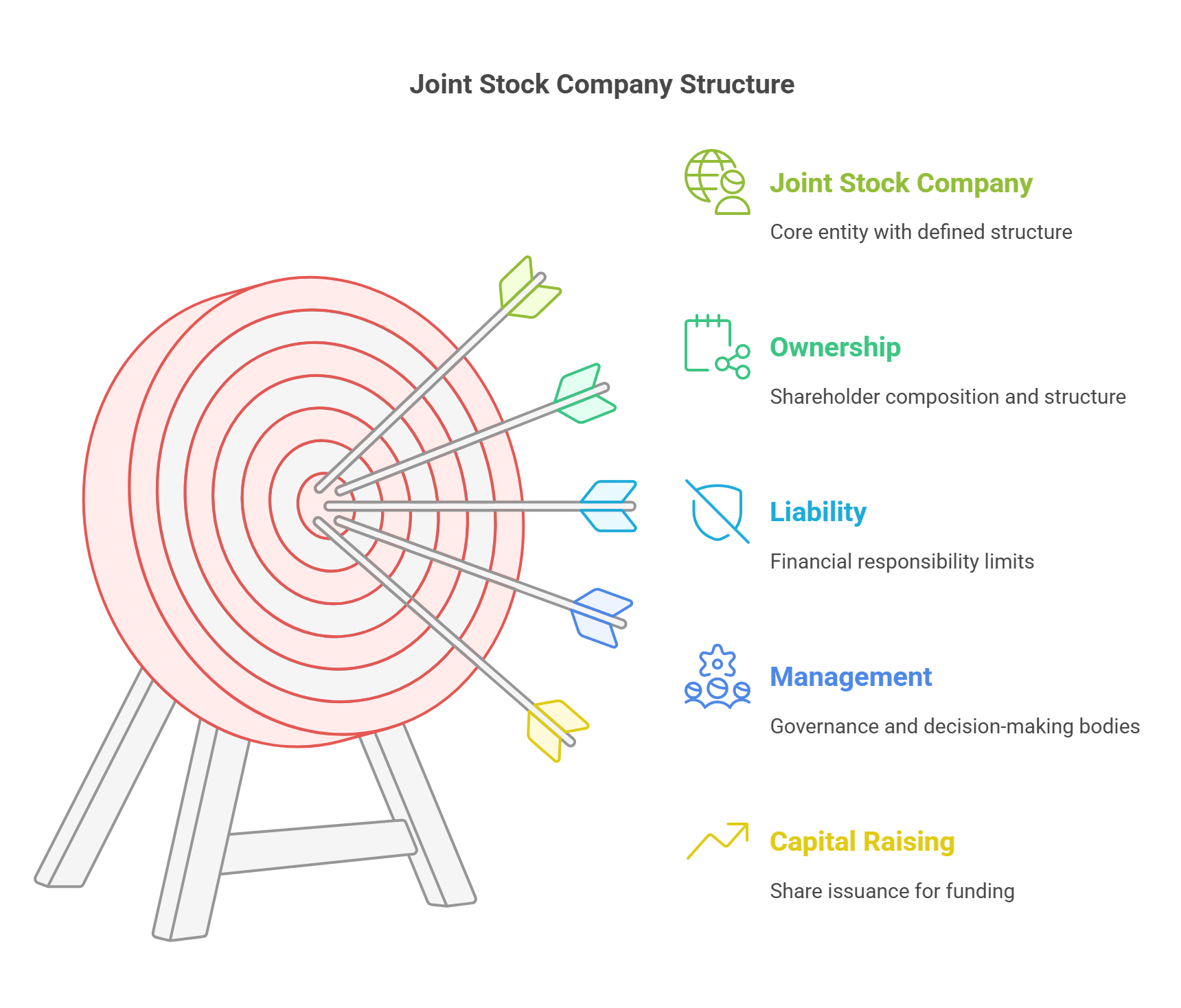

- Joint-Stock Company (JSC) –

A business structure requires at least three shareholders, and shares can be freely transferred. Liability is limited to the value of shares owned. This is a common structure for larger businesses planning to raise capital or go public.

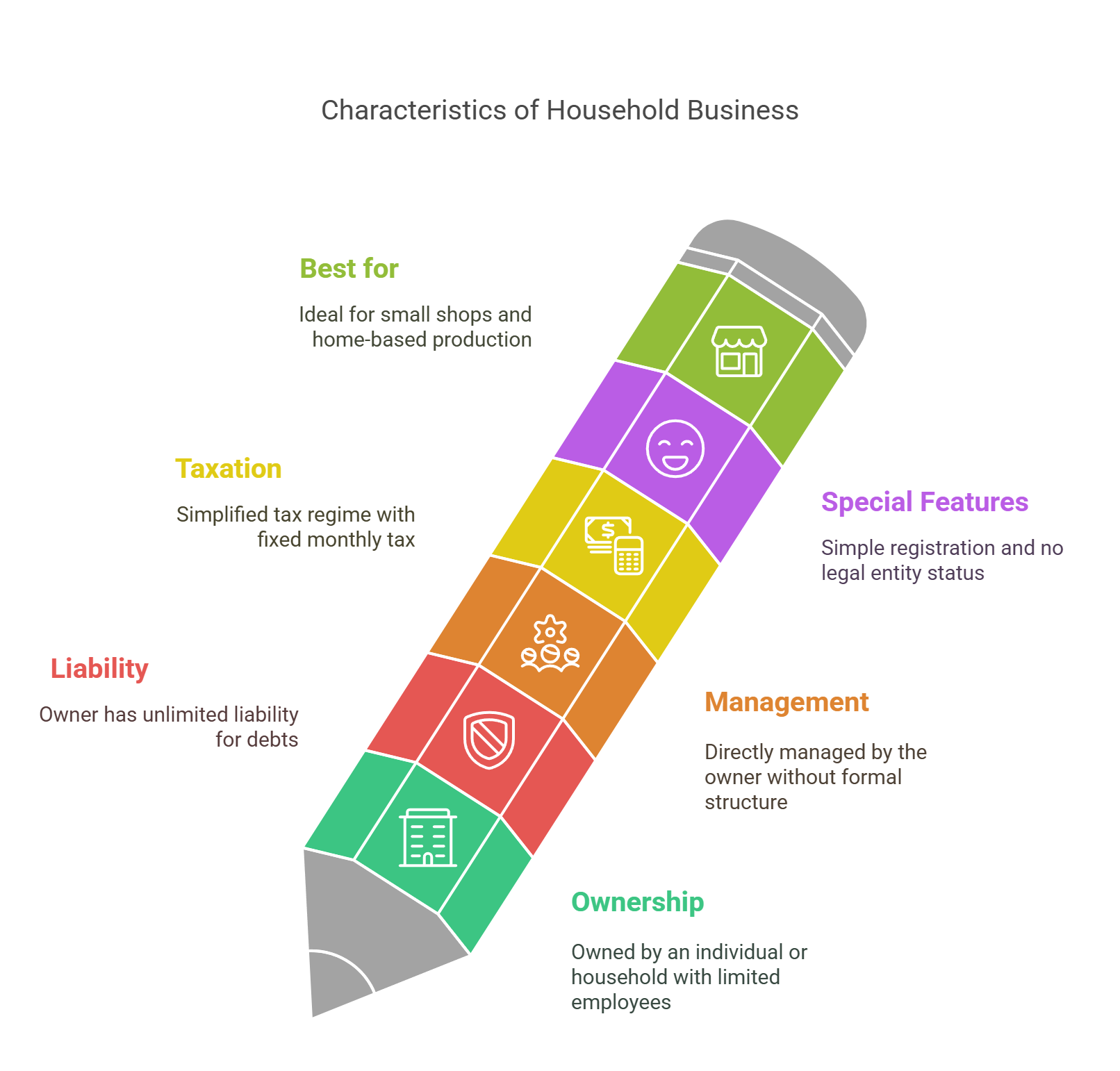

- Household Business

A small business structure, usually family-run, with simpler tax and accounting requirements.

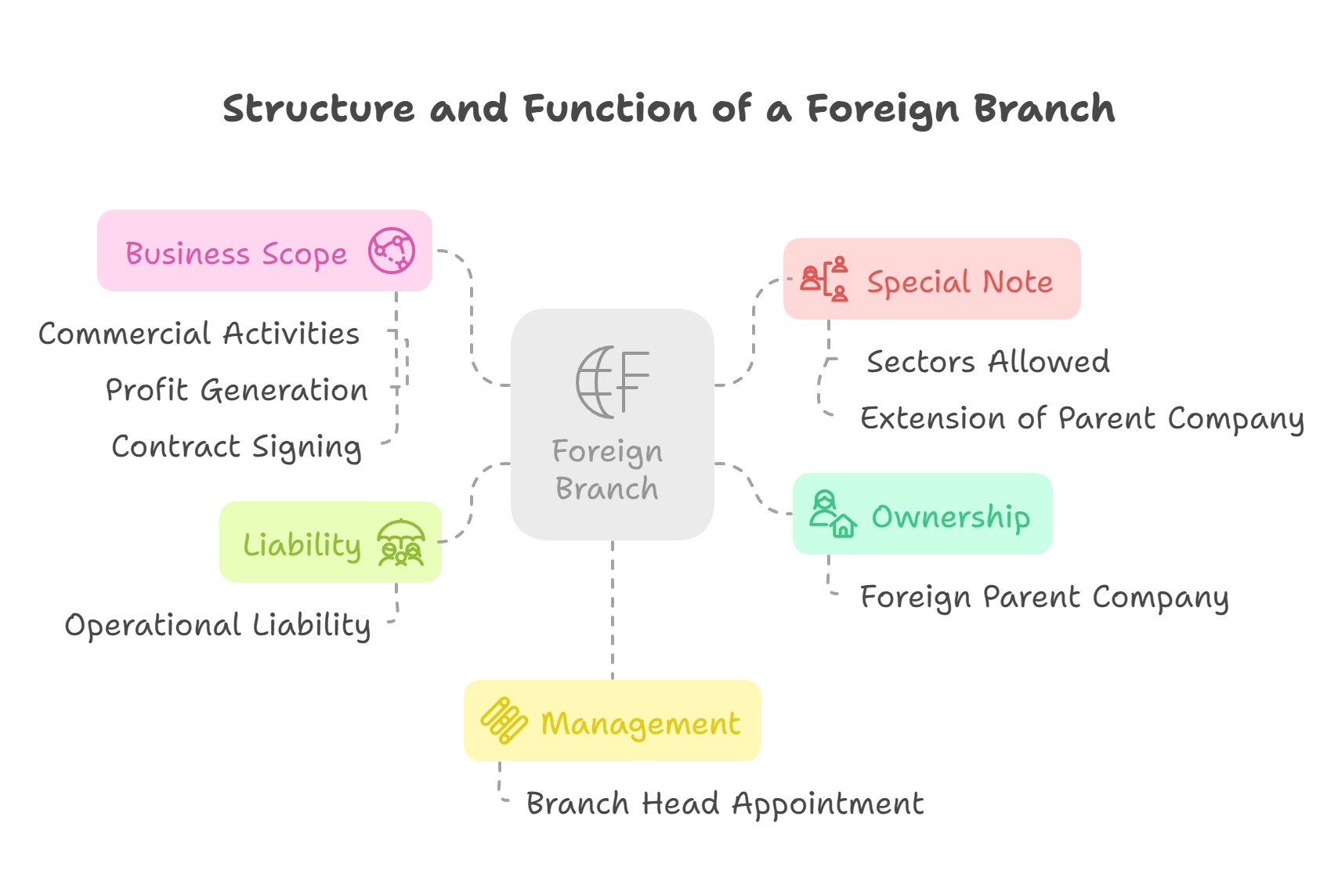

- Branch

An extension of a parent company (domestic or foreign), conducting commercial activities on behalf of the parent company.

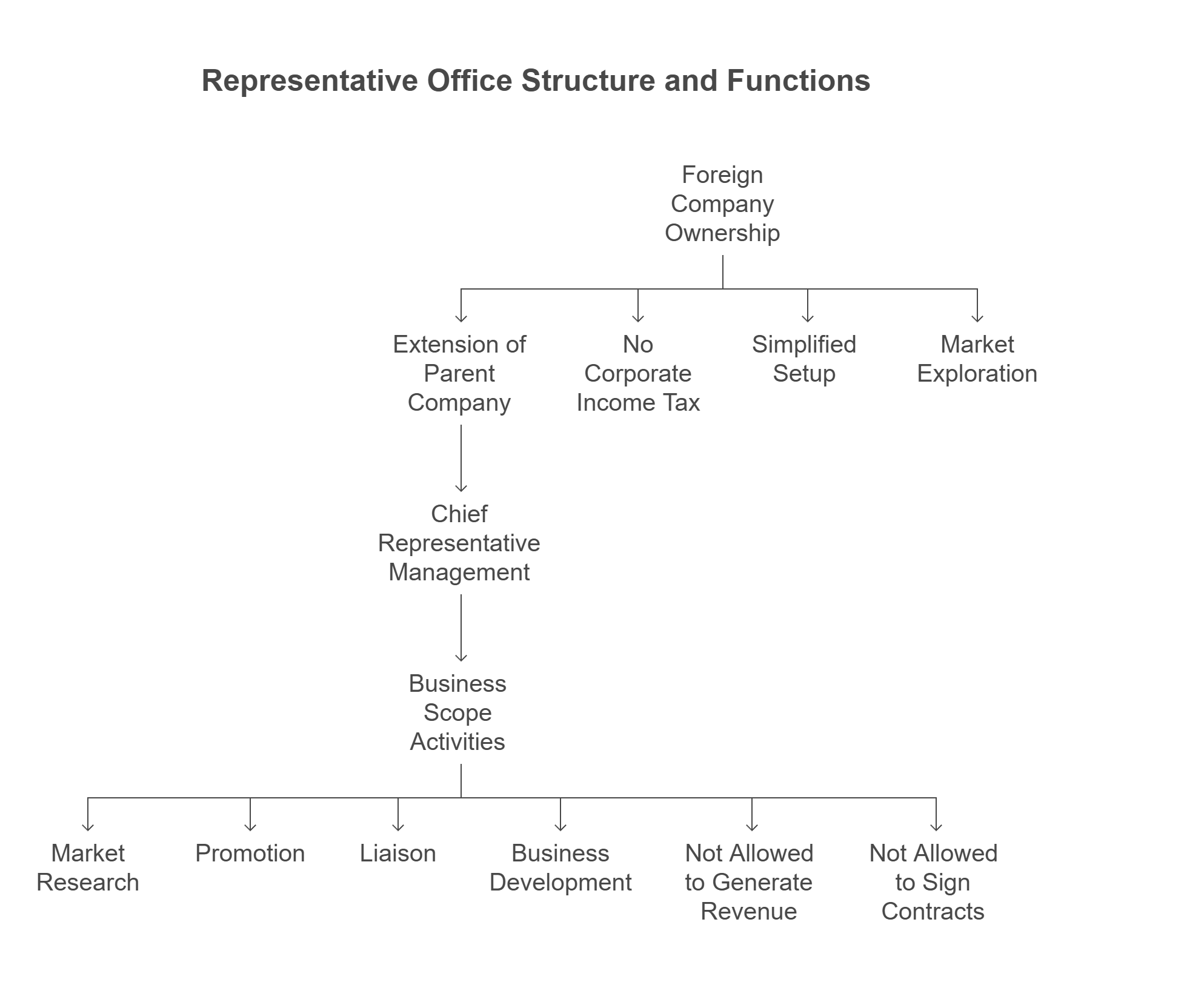

- Representative Office

A non-commercial office of a foreign company in Vietnam, mainly for market research, liaison, and promoting business — no profit-making activities allowed.

- Business Cooperation Contract (BCC)

A contractual relationship between foreign and local companies, without forming a separate legal entity. Each party retains its own legal status.

- Public-Private Partnership (PPP)

A collaboration between the state and private enterprises to execute infrastructure projects or public services, often in sectors like transportation, energy, or water supply.

- Cooperative

A business structure owned and operated by at least 7 members (individuals, households, or legal entities). Members contribute capital and/or labor and share profits based on their participation.

11 business structures in Vietnam

Key Details of Each Business Structures

The following outlines the key features of the most common business structures in Vietnam. Specifically,

A Comparison Table of Business Structures in Vietnam

For easy reference, the table below provides a comparison of various business structures in Vietnam, helping foreign investors evaluate their options when considering investment in the country.

Business Structure | Ownership | Liability | Management Structure | Capital Requirement | Special Features | Best For |

Private Enterprise | 1 individual | Unlimited (personal assets at risk) | Owner-managed | No minimum | Simple setup; owner controls all decisions and profits. | Small, personal businesses |

Partnership | 2+ partners (general/limited) | General: Unlimited; Limited: Limited | General partners manage | No minimum | Professional services model; limited partners contribute but don’t manage. | Law firms, auditing, consulting |

Single-member LLC | 1 individual or organization | Limited to owner’s capital | Owner or appointed manager | No minimum | Full control by owner; simpler structure than JSC; cannot issue shares. | Small to medium businesses |

Multi-member LLC | 2 to 50 members | Limited to members’ capital | Members’ Council, Director | No minimum | Flexible structure; inspection committee needed if >11 members. | Medium-sized businesses, joint ventures. |

Joint Stock Company (JSC) | Minimum 3 shareholders | Limited to shares owned | Shareholders’ Meeting, Board of Directors, CEO | VND 10 billion (for listed JSCs) | Can issue shares, raise capital publicly — suitable for large scale. | Large or fast-growing companies. |

Business Cooperation Contract (BCC) | Multiple parties (local/foreign) | Defined by contract | Defined by agreement | No minimum | No new legal entity; profit/loss distribution based on the contract. | Infrastructure projects, joint ventures. |

Public-Private Partnership (PPP) | Government + private investors | Defined by contract | Project-specific governance | Varies by project | Used for large infrastructure projects; private party assumes some risks. | Infrastructure, utilities, public services |

Foreign Branch | Foreign parent company | Parent company fully liable | Branch head appointed by parent company | No minimum | Acts as an extension of the parent company; limited to allowed sectors. | Banking, legal, specialized sectors |

Foreign parent company | Parent company fully liable | Chief Representative | No minimum | Cannot generate revenue; mainly for market research or brand representation. | Market entry, brand presence, liaison work | |

Cooperative | Minimum 7 members (individuals or entities) | Limited to members’ contributions | Management Board, Director | No minimum | Democratically run (one member = one vote); profits shared among members. | Agriculture, rural development, services |

Household Business (Hộ kinh doanh) | 1 individual or household | Unlimited (personal assets at risk) | Owner-managed | No minimum | Simple accounting, max 10 employees, limited to one location. | Small, family-run businesses, local shops |

Which Business Structure is Right for You?

Choosing the right business structure in Vietnam isn’t easy, as the legal framework doesn’t clearly define which option is best. That’s why thele.blog created this FAQ - to help investors gain a better understanding before making an informed decision.

Are these the only business structures for foreign investors in Vietnam, or are there more?

The above are merely common business structures in Vietnam available to foreign investors. Additionally, options such as purchasing stocks or properties are alternative business structures that foreign investors can consider.

I’m a bit confused between Private Enterprise and Household Business. Can you clarify the difference?

The two key differences between these business structures are:

Only individuals can own a Private Enterprise, whereas a Household Business can be owned by either an individual or a household.

Registration is also distinct. Private Enterprises must be registered through the National Business Registration Portal. In contrast, Household Businesses are registered at the District People’s Committee.

What is the difference between a Private Enterprise and a Single-Member LLC

The two key differences between these business structures are:

- Ownership: A Private Enterprise can only be owned by an individual, whereas a Single-Member LLC can be owned by either an individual or an organization.

- Liability: the owner of a Single-Member LLC is only liable for the company’s debts up to their contributed capital. In contrast, the owner of a Private Enterprise holds unlimited personal liability, meaning they are responsible for all debts and obligations beyond their initial investment.

I’ve heard of Cooperatives - why aren’t they considered a business structure in Vietnam?

In practice, “Cooperation” is just another term. It actually refers to the same business structure as a Joint Stock Company (JSC) in Vietnam.

Are all these types of business structures available to foreign investors in Vietnam?

Not all business structures in Vietnam are available to foreign investors. Household Businesses reserved exclusively for Vietnamese citizens.

What if I am a foreigner and wish to choose a household business as a business structure?

In practice, you can still choose household business structure in Vietnam. However, you will need to find a partner to invest through a nominee structure. For more details, please refer to our nominee structure service here.

Why do so many Vietnamese choose household or private enterprise as their business structure?

It is a traditional approach; however, thele.blog advises against these practices, as household and private enterprises are risky business structures due to the owner’s unlimited liability.

Which business structures in Vietnam are considered less favorable for foreign investors?

Choosing a business structure is ultimately not a major concern for foreign investors. Instead, the key question is which business sectors prohibit or restrict foreign investment.

>> Please find the list of 85 business lines restricted for foreign investors here.

Recommended Business Structures in Vietnam

If thele.blog is asked about the recommended business structures for foreign investors, please kindly note the following:

- There is no one-size-fits-all solution to these questions, as each business structure in Vietnam has its own pros and cons. Therefore, we recommend studying the key details of each structure and selecting the one that best suits your situation.

- The Single-member LLC, Multi-member LLC, and Joint Stock Company are the three most commonly favored business structures in Vietnam for foreign investors, as the owners of these structures have limited liability based on their capital contributions.

- In the bigger picture, choosing the right business structure in Vietnam must go hand in hand with proper documentation and capital arrangements. These factors can either take time and/or significantly impact how investors benefit from their business. A simple mistake could lead to unfortunate consequences.

In conclusion, the ideal business structure in Vietnam is one that limits the owner’s liability, is easy to incorporate, and aligns with the nature of the business.

Contact thele.blog Today

If you're still struggling to choose the right business structure in Vietnam, thele.blog is here to help guide you.

Our experienced lawyers will determine the best business structure for your situation, guiding you step-by-step in preparing the necessary documents and resources to start a business in Vietnam, all at an affordable fee.

Contact thele.blog at +84-81235-3839, email us at thele.blog@thele.blog, or simply fill out the form below — our lawyers will get back to you promptly.

Leave A Comment