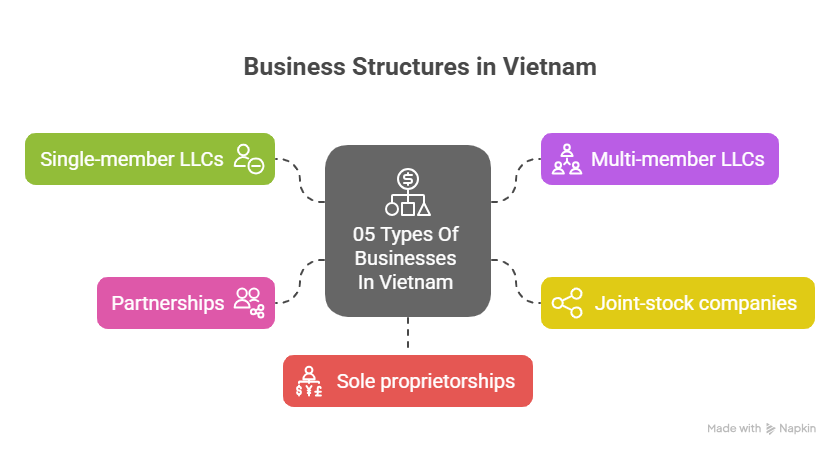

At the present time, there are primarily five main types of businesses in Vietnam:

- Single-member limited liability companies (LLCs)

- Multi-member limited liability companies (LLCs)

- Joint-stock companies (JSC)

- Partnerships

- Sole proprietorships

Each type of business has its own distinct characteristics, and individuals or organizations may choose the type of business that is most suitable for them based on their needs and capabilities. Below are the fundamental differences between these five types of businesses

Basic differences between types of businesses in Vietnam

Criterion | Single-member LLCs | Multi-member LLCs | Joint stock companies (JSC) | Partnerships | Sole proprietorships |

I. Legal Characteristics | |||||

Number of Members | – Member can be organization or individual – Only one member | – Members can be organizations or individuals. – From 2 to 50 members | – Shareholders can be organizations or individuals – The minimum number of shareholders is 3 and there is no limit on the maximum number of shareholders | – At least two general partners are individuals – Limited partners can be organizations or individuals | – Owned by an individual – An individual can only establish one sole proprietorship |

Liability for property obligations | Within the limit of the contributed capital | Within the limit of the contributed capital | Within the limit of the contributed capital | – General partners assume unlimited liability – Limited partners assume limited liability within the limit of the contributed capital | Unlimited liability |

The status of a juridical person | Yes | Yes | Yes | Yes | No |

Issuance of securities | – Not allowed to issue shares – Allowed to issue bonds | – Not allowed to issue shares – Allowed to issue bonds | Allowed to issue shares, bonds, and other forms of securities | Not allowed to issue any form of securities | Not allowed to issue any form of securities |

II. Charter Capital | |||||

Time limit for Capital contribution | – 90 days from the Enterprise Registration Certificate’s (ERCs) date of issue. | – 90 days from the Enterprise Registration Certificate’s (ERCs) date of issue. | – 90 days from the Enterprise Registration Certificate’s (ERCs) date of issue; or – Other terms decided by the company | – No regulation The time limit for capital contributions will be determined by the general partners and limited partners | |

Increase/decrease of charter capital | – Increase charter capital: + Increase in the owner’s capital contribution; +Receipt of capital contributions from other parties. – Decrease charter capital + Partial return of the contributed capital to the company’s owner + Failure to make full and punctual capital contributions by the owner | – Increase charter capital: + Increase in the members’ capital contribution; + Receipt of capital contribution from new members. – Decrease charter capital + Partial return of the contributed capital to the member in proportion to their holdings; + Repurchases of members’ shares by the company + Failure to make full and punctual capital contributions by members | – Increase charter capital Increase in the quantity and types of authorized stocks

– Decrease charter capital + Partial return of the contributed capital to the shareholders in proportion to their holding + Repurchases of sold shares by the company + Failure to make full and punctual capital contributions by members | – Increase charter capital Admission of new partners – Decrease charter capital + Withdrawal of limited partner + Termination of general partners status | Sole proprietorship owners are entitled to increase or decrease the charter capital at their own discretion |

Capital transfer | Owner is entitled to transfer all or part of the company’s charter capital to another organization or individual | Member is entitled to transfer all or part of their shares to other organizations/individuals | Shares may be freely transferred, with the exception of: Within 3 years from the ERCs date of issue, the founding shareholder’s ordinary shares may be transferred to other founding shareholders and can only be transferred to a person who is not a founding shareholder – if approved by the General Meeting of Shareholders | + A general partner may not transfer all or part of their stake to another organization or individual unless accepted by other general partners. + A limited partner may freely transfer their stake to other individuals. | Owner is entitled to lease or sell sole proprietorships to another organization or an individual |

III. Organizational structure | |||||

Organizational structure | – If the owner of the company is an individual: + President and a Director/General Director – If the owner of the company is an organization Operates under one of the two following models: + President and Director/General Director + Board of Members and the Director/General Director | – Board of Members, President of the Board of Members, Director/General Director – Board of Members is the supreme governing body of the company and meetings are held at least once per year | The company may choose one of the following models: – General Meeting of Shareholders, Board of Directors, Board of Controllers, and Director/General Director – General Meeting of Shareholders, Board of Directors, and Director/General Director The General Meeting of Shareholders consists of all voting shareholders and is the supreme body of a JSC General Meeting of Shareholders is conducted annually or whenever necessary | – Board of Members – President of the Board of Members – Director/General Director The Board of Members consists of all general partners and limited partners. | – Owner – Director/General Director |

Legal Representative | – Board of Members – Company’s President Or – Director/General Director | President of the Board of Members or Director/General Director | President of the Board of Directors or the Director/ General Director | General partners | The owner |

The right to decide important issues | Owner | Board of Members | General Meeting of Shareholders | The Board of Members has the right to decide all business affairs of the company. However, all decisions must be approved by the majority of the general partners. | The owner has sole authority to decide all of its business activities |

The choice of business type depends on the industry, organizational model, and structure that best aligns with the company’s development goals. To select the most suitable business type and for assistance in establishing a company, please contact us for expert advice and establishment service with promotional pricing.

Leave A Comment